Mike Ashley’s Frasers Group PLC’s (GB:FRAS) increased takeover offer to acquire the Mulberry Group (GB:MUL) has been turned down by the fashion brand owner. Mulberry’s majority shareholder, Chalice Limited, has expressed no interest in selling its shares. Challice further stated that the offer came at an inappropriate time and it “regrets the distraction” the potential offer is causing for the company. FRAS stock was down 0.25% as of writing, whereas Mulberry shares gained over 20%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Frasers Group, founded by billionaire Mike Ashley, is a retail company offering a range of clothing, sports, and lifestyle products. Meanwhile, Mulberry is a manufacturer of luxury leather handbags.

Mulberry Rejects Frasers Group’s £111m Bid

Mulberry’s statement followed Frasers Group’s increase in its offer to 150p per share last week, valuing the company at £111 million. The bid offered a significant premium over Mulberry’s recent share price and the emergency funding subscription rate. Earlier this month, Mulberry rejected a £83 million bid, valued at 130p per share.

Frasers Group currently owns 37% of Mulberry and has earlier expressed concerns about the handbag maker’s future. Mulberry has struggled in recent years amid growing competition in the luxury market and broader challenges in the sector. With this deal, Frasers aimed to fully acquire Mulberry by securing the remaining 63% stake.

Frasers’ board is consulting with advisers to assess the company’s position and will issue a further update in due course. Under UK takeover rules, Frasers has time until October 28 to either submit a formal offer for Mulberry or exit the bidding process.

Is Fraser Group a Good Buy?

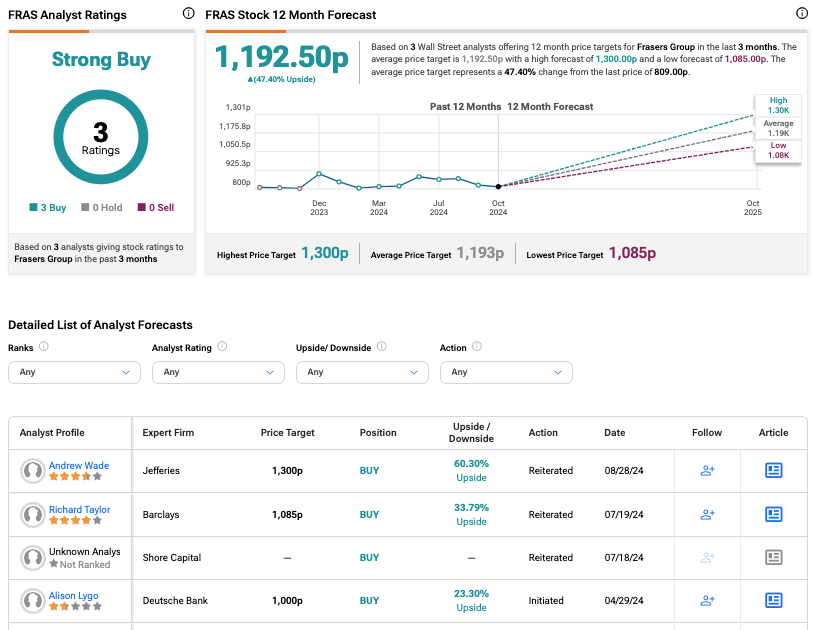

On TipRanks, FRAS stock has been assigned a Strong Buy consensus rating based on three Buy recommendations. The Frasers’ share price target is 1,192.50p, which is 47.4% above the current level.