Shares of MTY Food Group (MTY) gained almost 15% in early trading on Friday after the company reported a profit in its second quarter and announced it would start paying dividends again. MTY is behind more than 80 restaurant brands, including well-known food court brands like Thai Express, Extreme Pita, and Tiki-Ming.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue came in at C$135.9 million in the three months ended May 31, an increase of 39% from C$97.8 million in the prior-year quarter.

Meanwhile, Net income attributable to shareholders amounted to C$23 million (C$0.93 per share) in Q2 2021, up from a net loss of C$99.1 million (-C$4.01) in Q2 2020.

The franchisor and restaurant operator, which suspended its dividend last year when the pandemic forced restaurants to close, said it would pay a quarterly dividend of C$0.185 per share next month.

MTY CEO Eric Lefebvre said, “We are extremely pleased to note that the adjusted EBITDA for the quarter more than doubled over last year to $43.5 million despite the lingering impact of the pandemic, making it one of our best quarters ever. This reflects a marked recovery in Canada as well as organic growth of $15.3 million in the US and International segment. This translated into strong cash flows from operating activities, which reached $29.5 million. This allowed us to further reduce our debt level by $15 million, bringing total repayments since the start of the pandemic to close to $145 million.”

MTY said that at the end of the quarter, 359 locations were still temporarily closed due to the pandemic, including 283 in Canada, 54 in the United States, and 22 internationally. The company said that 258 locations are still temporarily closed as of Friday, July 9. (See MTY Food Group stock charts on TipRanks)

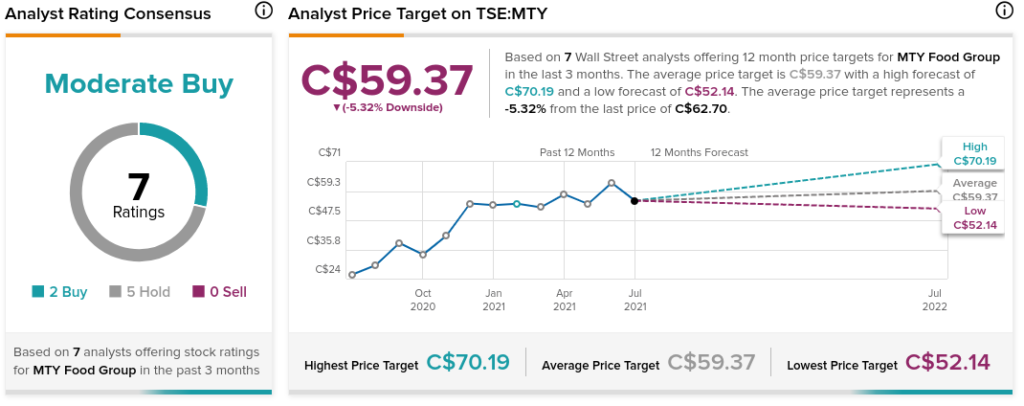

Last week, National Bank Financial analyst Vishal Shreedhar maintained a Hold rating on MTY with a C$58.00 price target. This implies 7.5% downside potential.

Overall, consensus among Wall Street analysts is that MTY is a Moderate Buy based on 2 Buys and 5 Holds. The average MTY Food Group price target of C$59.37 implies 5.3% downside potential to current levels.

Related News:

RBC and DoorDash Partner to Bring Deals and Savings to Canadians

Couche-Tard Posts Better-Than-Expected Q4 Results; Shares Gain Almost 5%

Empire Q4 Sales and Profit Drop, Dividend Hiked 15.3%; Shares Lose More Than 5%