Shares of Microstrategy (NASDAQ:MSTR) fell in after-hours trading after the analytics software company, better known for its massive Bitcoin Holdings, reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at -$8.26, which missed analysts’ consensus estimate of -$0.55 per share. Sales decreased by 5.2% year-over-year, with revenue hitting $115.25 million. This missed analysts’ expectations by $6.1 million.

However, investors are likely more interested in the company’s Bitcoin. As of April 26, Microstrategy held 214,400 Bitcoin at an average cost of $35,180 per Bitcoin. This equates to a total value of $7.54 billion. This comes after it acquired 25,250 Bitcoin since the end of Q4 at an average price of $65,232.

Is MSTR a Good Stock to Buy?

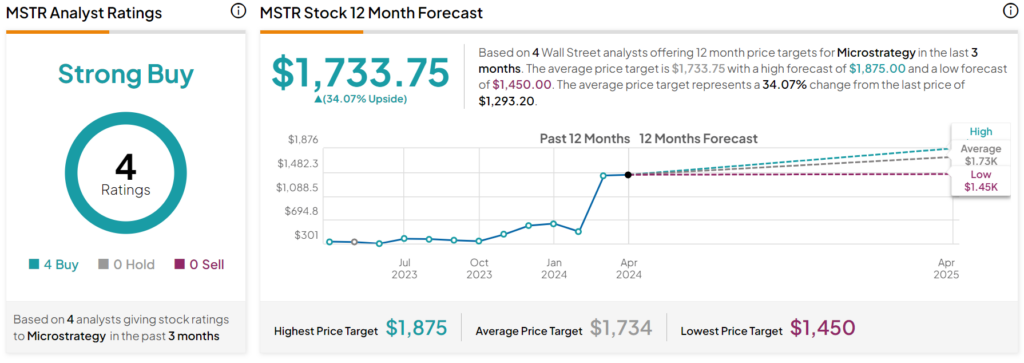

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on four Buys assigned in the past three months, as indicated by the graphic below. After a 320% rally in its share price over the past year, the average MSTR price target of $1733.75 per share implies 34.07% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

Is It Wise to Allocate $1,000 Toward MSTR Stock Right Now?

Before you hurry to invest in MSTR, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Microstrategy is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

See The Stocks >>