Diversity, equity, and inclusion (DEI) were largely embraced by multiple companies as key policy pillars in recent years. “Being woke,” in this context, refers to a heightened awareness and proactive stance on social justice issues, including DEI. However, the shifting sands of time are leading to a change of heart, and the latest name to part ways with its woke approach is none other than tech giant Microsoft (MSFT).

Microsoft Steps Back from DEI

Microsoft had invested a lot of money into its DEI policies. However, earlier this month, the company laid off its DEI team, saying it was due to “changing business needs.” It’s still unclear how many MSFT employees were affected by this move.

Furthermore, Microsoft is not the only company taking a step back from DEI. Other names, such as Google (GOOG) and Meta (META), have also cut DEI-associated positions in recent times. According to Indeed, DEI-associated job postings plunged by nearly half last year.

While part of this trend can be attributed to tough economic conditions and AI-driven uncertainties, it seems highly unlikely that companies would embrace DEI again in a hurry. Global geopolitical tensions, a changing political landscape, and a razor-sharp focus on corporate profitability could act as contributing factors in this dynamic.

What’s Next for MSFT Investors…

Meanwhile, investors’ focus will now shift to MSFT’s Q4 numbers on July 30. Analysts expect the company to post an EPS of $2.93 on revenue of $64.37 billion for the quarter. In the comparable year-ago period, MSFT’s EPS of $2.69 had comfortably outpaced estimates by $0.14.

Is Microsoft a Buy, Sell, or Hold?

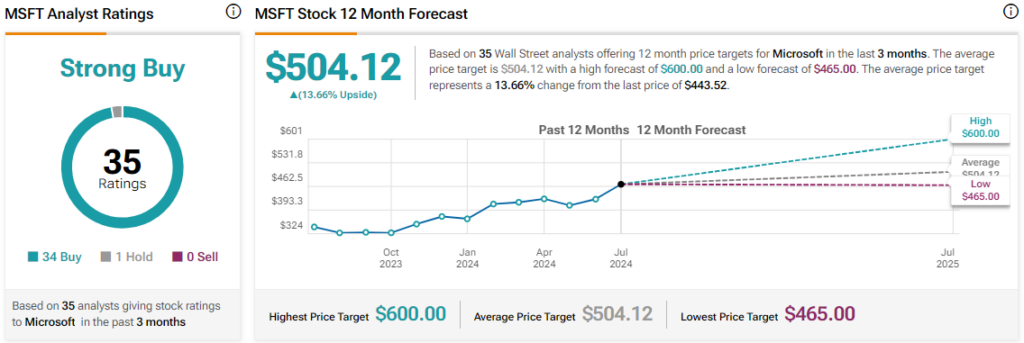

Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average MSFT price target of $504.12. The company’s share price is up by nearly 25% over the past year.

Read full Disclosure