TipRanks’ Top Hedge Fund Managers tool allows users to track the investment portfolios of leading financial professionals. Today, we have focused on the three top picks – Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), and Intuit (NASDAQ:INTU) – of a leading hedge fund manager Donald R. Jowdy from Suncoast Equity Management.

Before moving ahead, let’s learn more about the hedge fund manager, Donald R. Jowdy.

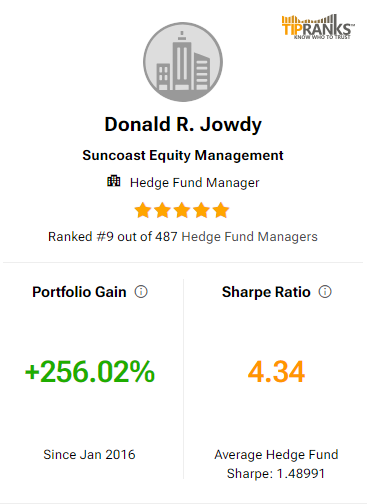

According to the rankings, Jowdy is ninth among the 487 hedge fund managers evaluated by TipRanks. It should be noted that he has a proven track record, with a cumulative gain of 256.02% since January 2016 and an average return of 28.05% over the past 12 months.

Importantly, a hedge fund manager’s return on a portfolio is best indicated by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Jowdy has a Sharpe ratio of 4.34.

With this background, let’s explore what the Street is saying about Jowdy’s key picks.

Is Microsoft a Buy, Sell, or Hold?

Microsoft is a multinational technology company known for its software products, including the Windows operating system and its Azure cloud computing services. MSFT stock constitutes 9.02% of Jowdy’s portfolio.

The company benefits from its strong presence in the software development market. Moreover, AI investments, along with the expansion of cloud computing and gaming units, might continue to aid MSFT’s growth.

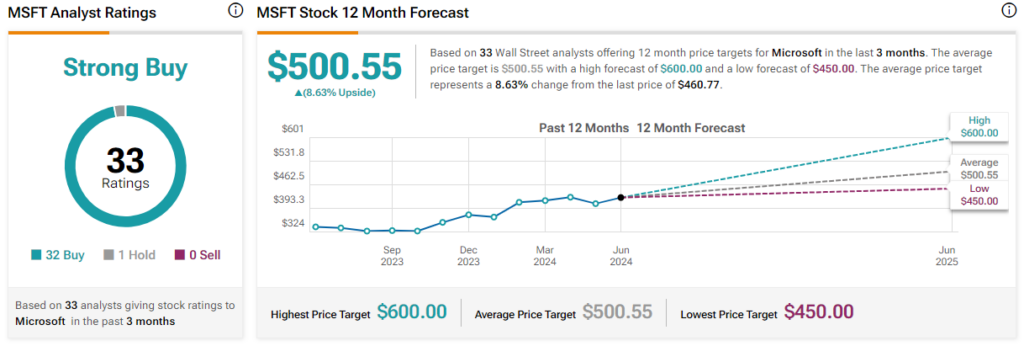

Overall, MSFT has a Strong Buy consensus rating on TipRanks, based on 32 Buys and one Hold. Further, the analysts’ average price target on Microsoft stock of $500.55 implies an 8.63% upside potential to current levels. Shares of the company have gained 23% year-to-date.

Is Nvidia a Buy, Sell, or Hold?

NVDA manufactures computer graphics processor units (GPUs), chipsets, and related multimedia software. Nvidia stock currently comprises 6.08% of Jowdy’s portfolio.

The company’s dominant position in the GPU market might continue to support its growth. Further, NVDA’s robust cash position is expected to support its ongoing efforts to lead in the AI race through new product launches.

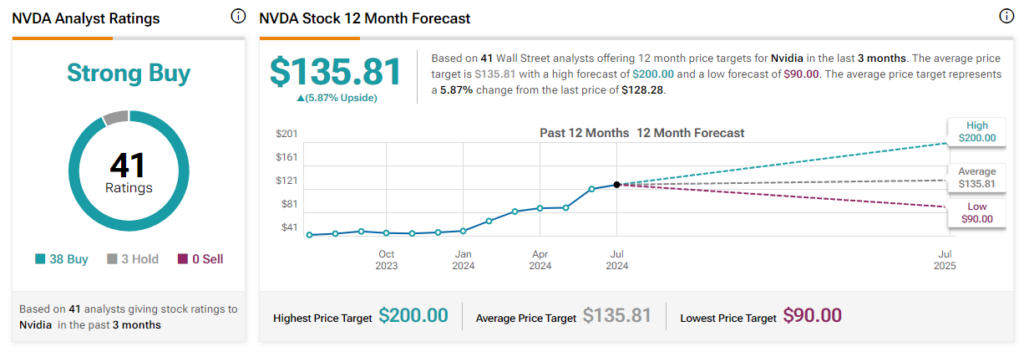

With 38 Buy and three Hold ratings, Nvidia has a Strong Buy consensus rating. On TipRanks, the analysts’ average price target on NVDA stock of $135.81 implies 5.87% upside potential from current levels. Year-to-date, shares of the company have gained 159.1%.

Is INTU a Good Stock to Buy Now?

INTU is a financial software company that provides solutions for small businesses and personal finance management. Jowdy’s portfolio allocation for Visa stock currently represents 5.77%.

Intuit’s investments in generative AI should support its bottom-line growth. At the same time, strong financial performance and a focus on international expansion should bolster the company’s prospects.

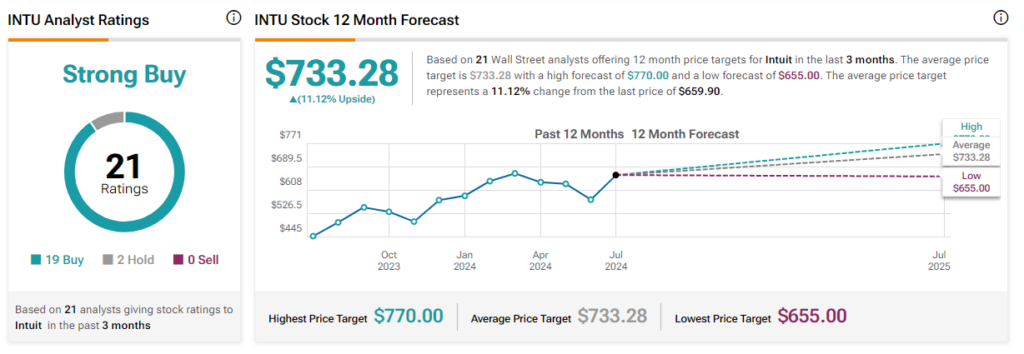

On TipRanks, INTU has a Strong Buy consensus rating. This is based on 19 Buy and two Hold recommendations. The analysts’ average price target on Intuit stock of $733.28 implies 11.12% upside potential. Shares of the company have gained 5.89% so far in 2024.

Concluding Thoughts

Impressive portfolio gains by the leading hedge fund managers may encourage investors to adopt their portfolio allocation strategy. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.