Merck (NYSE:MRK) delivered a Q1 earnings beat on Thursday, with reporting adjusted earnings reaching $2.07 per share, compared to $1.40 per share in the same period last year. This exceeded analysts’ estimates of $2.04 per share.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The pharmaceutical giant generated Q1 revenues of $15.78 billion, marking an 8.8% increase year-over-year, which surpassed consensus estimates of $15.2 billion. The company’s revenues were boosted by its oncology medicines and vaccine sales. Indeed, Merck’s pharmaceutical business reported sales of $14.01 billion in the first quarter, representing a 10% increase year-over-year.

The company also received approval from the U.S. Food and Drug Administration (FDA) for Winrevair, the first-in-class treatment for adults with pulmonary arterial hypertension (high blood pressure).

Merck’s Forward Guidance

Looking forward, Merck raised its FY24 forecast and expects that sales will be in the range of $63.1 billion to $64.3 billion, compared to its prior outlook between $62.7 billion and $64.2 billion. The company has projected that adjusted earnings will be between $8.53 and $8.65 per share, compared to its prior guidance of earnings in the range of $8.44 to $8.59 per share.

Is MRK a Good Stock to Buy?

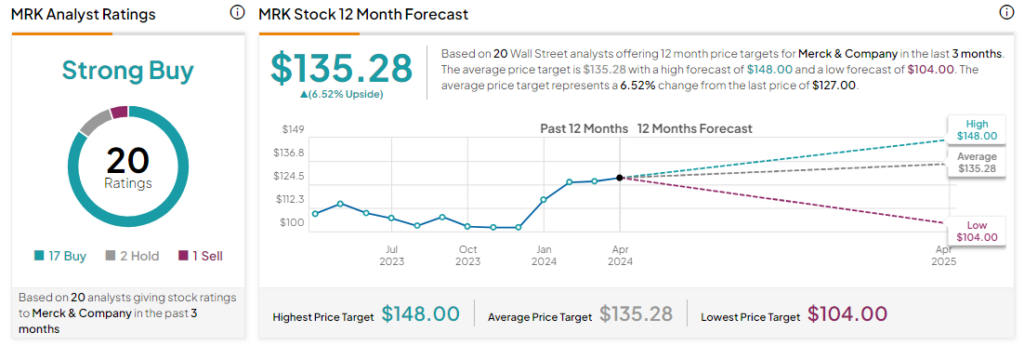

Analysts are bullish about MRK stock, with a Strong Buy consensus rating based on 17 Buys, two Holds, and one Sell. Year-to-date, Merck has increased by more than 15%, and the average MRK price target of $135.28 implies an upside potential of 6.5% from current levels. These analyst ratings are likely to change following Merck’s Q1 results today.