Shares of The Mosaic Co. (MOS) tanked 6.7% in Tuesday’s extended trading session and a further 5.4% at the time of writing after the company reported lower-than-expected results for the fourth quarter of 2021.

Mosaic engages in the production and marketing of concentrated phosphate and potash crop nutrients. Shares of MOS have gained 55.4% over the past year.

Mosaic’s adjusted earnings stood at $1.95 per share, up almost four times from the last year’s adjusted earnings of $0.57 per share. However, the figure missed analysts’ estimate of $1.98 per share.

Meanwhile, revenues of $3.84 billion also failed to meet expectations of $3.9 billion. Nevertheless, revenues grew 56.3%, compared to the prior-year quarter on the back of higher pricing trends, which more than offset lower volumes.

During the quarter, the selling price of phosphate rose 86.2% year-over-year but sales volume declined 21.7%. Further, Potash’s average selling price climbed 133.9% to $414 per tonne and sales volume fell 22.2%.

Mosaic’s President and CEO, Joc O’Rourke, said, “As a result of successful investments like our new Esterhazy K3 potash mine, Mosaic Fertilizantes in Brazil, and our cost-structure transformation, we are generating tremendous value in the current environment. This has provided us with the opportunity to return significant capital to shareholders, while still investing efficiently in the business and strengthening the balance sheet.”

Mosaic expects the upward pricing trend to continue in the first quarter, with higher average realized prices. Phosphate prices are expected to be more than $60 per tonne and volume will likely be in the range of 1.6 to 1.8 million tonnes. Potash prices are expected to be above $125 per tonne and volume between 1.8 to 2.0 million tonnes.

Capital Deployment Plans

The company seeks to initiate an accelerated share repurchase of $400 million in February. Also, the Board of Directors has approved a new $1 billion share repurchase authorization, effective immediately following completion of the current program.

Further, the company has also approved a regular dividend target increase to $0.60 per share annually from $0.45.

Stock Rating

Based on 6 Buys and 2 Holds, the stock has a Strong Buy consensus rating. The average Mosaic price target of $50.25 implies 13.7% upside potential from current levels.

Positive Sentiment

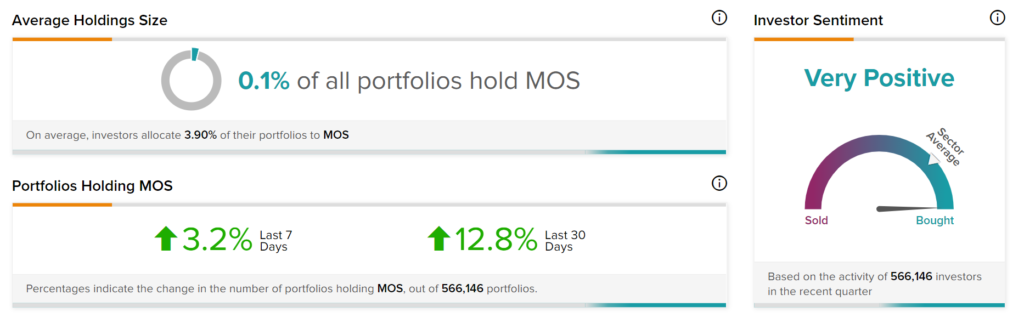

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Mosaic, with 12.8% of investors increasing their exposure to MOS stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

CoStar Dips 21.5% Despite Q4 Results Beat

Krispy Kreme Gains 8.4% as Revenue Exceeds Expectations

Home Depot Posts Strong Q4 Results; Shares Gain Pre-Market