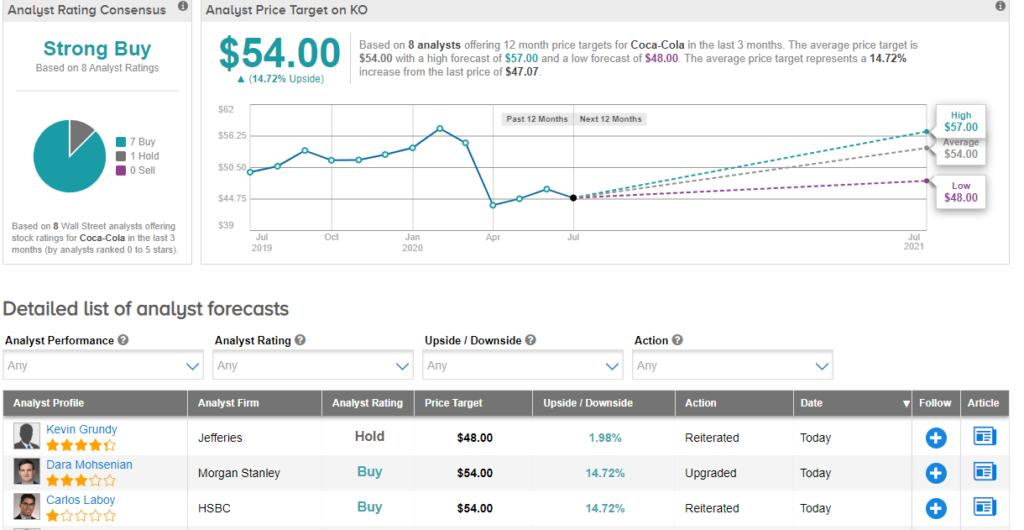

Morgan Stanley analyst Dara Mohsenian upgraded Coca-Cola (KO) stock to buy from hold, citing the company’s compelling valuation. The analyst also raised the price target to $54 from $52.

According to Mohsenian, “the stock’s recent underperformance and its outsized valuation discount vs. peers has become too pronounced in our minds, despite greater short-term pressure from COVID with half of Coke’s sales mix in away-from-home.” Moreover, the analyst believes that 2Q was the bottom, and the forward consensus estimates are also reasonable to support its valuation.

The upgrade follows Coca-Cola’s challenging 2Q performance. Its stock rose 2.34% on Tuesday after management was cautiously optimistic on its outlook.

“We believe the second quarter will prove to be the most challenging of the year; however, we still have work to do as we drive our pursuit of ‘Beverages for Life’ and meet evolving consumer needs” said James Quincey, CEO of The Coca-Cola Company.

RBC Capital analyst Nik Modi also reiterated the buy call with a price target of $55. The analyst said, “trends should continue to improve with the reopening of cities/states/countries, but rising case counts and differing opinions on back-to-school will likely put pressure on the name through year-end.”

Overall KO shows a Strong Buy Street consensus. The average analyst price target stands at $54, implying a potential upside of 14.7%. (See Coca Cola’s stock analysis on TipRanks).

Related News:

Tesla Drops 4.5% After JMP Securities Downgrade

Moderna Slumps 13% After J.P. Morgan Downgrade

Lockheed Martin Beats Quarterly Estimates, Raises 2020 Outlook