Morgan Stanley upgraded Eli Lilly to Buy from Hold and raised the stock’s price target to $176 (17.7% upside potential) from $157, citing strong prospects for its Phase 3 diabetes asset tirzepatide.

Morgan Stanley analyst David Risinger said that “We extended our model through 2025 and raised our LT EPS growth projection from 12% to 14%. We are bullish on prospects for Phase 3 diabetes asset tirzepatide and note that LLY shares offer Alzheimer’s optionality.”

During the 2Q, the drug maker Eli Lilly (LLY) saw increased demand for its diabetes drug, Trulicity, which helped the company post upbeat earnings of $1.89 per share, as compared to analysts’ estimates of $1.56 per share. Nonetheless, the pharma giant reported lower-than-expected 2Q sales of $5.5 billion. Analysts had anticipated sales of about $5.8 billion.

Eli Lilly raised its full-year earnings guidance to $7.20 – $7.40 per share, as compared to the prior earnings range of $6.70 – $6.90 per share. Lilly’s CEO David A. Ricks said that “We expect growth in new prescription volume for our key growth products in the second half of 2020, and we remain confident in our outlook for the year.” (See LLY stock analysis on TipRanks).

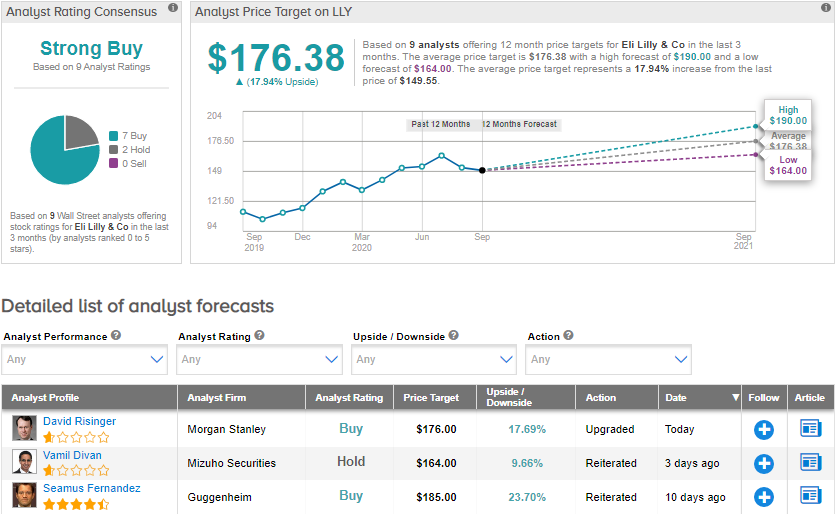

Currently, the Street shares Risinger’s bullish outlook on the stock. The Strong Buy analyst consensus is based on 7 Buys and 2 Holds. With shares up about 16.4% this year, the average price target of $176.38 implies upside potential of about 18% to current levels.

Related News:

Eli Lilly Drops 5% On Weak 2Q Sales; Analyst Says Hold

Ambarella Drops 3% In Pre-Market On Dim 3Q Sales Outlook

Copart Gains 4% in After-Hours On Quarterly Sales Win