2022 was a strange market for cars. With supply starting to come back online, the value of a used car started to plunge along with the influx of supply. However, Morgan Stanley (NYSE:MS) had a warning for auto stocks, as well as for their investors: brace for impact. As rough as 2022 was, it may get even rougher in 2023.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

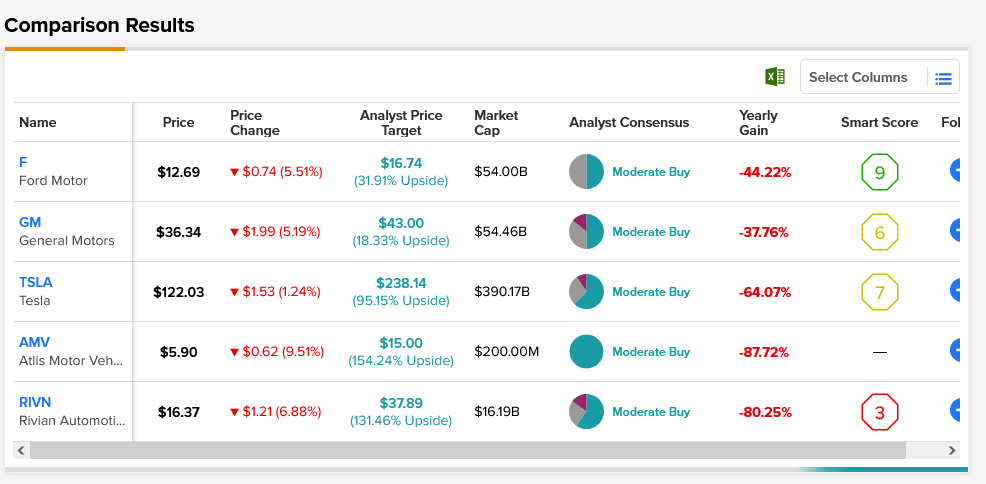

Morgan Stanley’s wide-ranging warning came from analyst Adam Jonas. It covered a panoply of auto stocks from across the entire range of automotive operations. The analyst covered the standards that focus on internal combustion, like Ford (NYSE:F) and General Motors (NYSE:GM). Both companies took a hit in Friday’s trading, and further declines will likely follow the farther we get into 2023. After all, both Ford and General Motors will face the UAW later on, and labor negotiations have long proven rough for these two automotive giants.

Nevertheless, Morgan Stanley’s warning didn’t stop there. Tesla’s (NASDAQ:TSLA) recent price cuts will likely impact the company’s cash flow. This comes after a major sell-off representing a vote of waning confidence in current CEO Elon Musk. Musk’s recent purchase of Twitter left Tesla investors scratching their heads and selling their shares. Several electric vehicle makers, like Atlis Motor Vehicles (NASDAQ:AMV) and Rivian Automotive (NASDAQ:RIVN), also lost ground. Jonas’ final word for the car companies was simple, stark, and downright terrifying: “…we expect a significantly slower pace of investment as the cyclical downturn forces incremental capital discipline.”

All five companies were down in the wake of Jonas’ remarks. Yet the extent of that impact varied. Analyst consensus calls all five stocks Moderate Buys. Despite this, the upside potential for each varies wildly. General Motors stock currently offers the lowest potential. Its average price target of $43 gives it 18.33% upside potential. However, Atlis stock boasts 154.24% upside potential thanks to its $15 per share average price target.