New York-based credit rating and risk analysis firm Moody’s Corp. (MCO) has reported impressive second-quarter 2021 financial results on the back of strong demand for its suite of risk assessment products.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reported adjusted earnings per share (EPS) of $3.22, up 15% year-over-year, beating the Street’s estimate of $2.74. Quarterly revenue grew 8% to $1.6 billion, surpassing analysts’ expectations of $1.47 billion.

Revenue for Moody’s Investors Service (MIS) increased 4% year-over-year to $980 million, and Moody’s Analytics revenue surged 15% to $573 million. (See Moody’s stock chart on TipRanks)

The President and CEO of Moody’s, Rob Fauber, said, “Due to our robust first-half performance, we now forecast Moody’s full-year 2021 revenue to increase in the low-double-digit percent range and are raising our full-year 2021 adjusted diluted EPS guidance range to $11.55 to $11.85.”

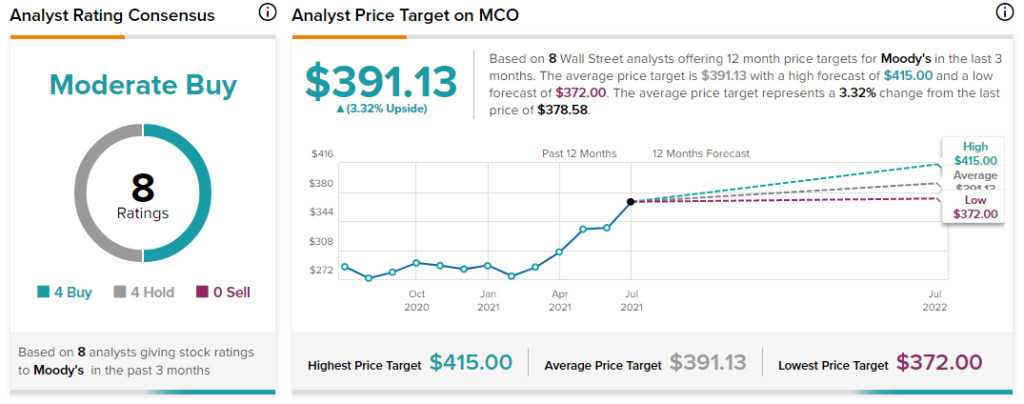

Following the announcement of the second-quarter results, UBS analyst Alex Kramm downgraded the stock to Neutral from Buy but increased the price target from $383 to $392 (3.5% upside potential).

In a research note to investors, the analyst expressed concern and said, “Following two years of outsized debt issuance levels, the medium-term outlook can only soften from here.”

Overall, the stock has a Moderate Buy consensus based on 4 Buys and 4 Holds. The average Moody’s price target of $391.13 implies a 3.3% upside potential to current levels. The company’s shares have gained nearly 42.2% over the past six months.

Related News:

What Do Whirlpool’s Risk Factors Indicate?

Thermo Fisher Ups Guidance on Impressive Q2 Results

Norfolk Southern Posts Strong Q2 results