Moody’s Corp. (MCO) has disclosed its plans to invest $250 million in BitSight, a cybersecurity ratings company. With this investment, BitSight will acquire VisibleRisk, a cyber risk ratings joint venture created by Moody’s and Team8.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The deal will be funded with cash in hand and is unlikely to have a material impact on Moody’s financial results for the current year. Also, BitSight will create a separate Risk Solutions Division, which will cater to critical solutions and analytics serving stakeholders, including chief risk officers, c-suite executives and boards of directors.

The investment is expected to bolster BitSight’s offerings and capabilities to create a much-needed comprehensive, integrated, industry-leading cybersecurity risk platform. The company said, “A Moody’s Investors Service review of cyber vulnerability and impact identified 13 sectors with high or medium-high risk with total rated debt exceeding $20 trillion.”

Notably, the acquisition of VisibleRisk is likely to add a unique in-depth cyber risk assessment capability and advance ability to analyze and calculate an organization’s financial exposure to cyber risk. (See Moody’s stock charts on TipRanks)

The President and CEO of Moody’s, Rob Fauber, said, “Creating transparency and enabling trust is at the core of Moody’s mission – to help organizations assess complex, interconnected risks and make more informed decisions.”

On September 7, Oppenheimer analyst Owen Lau reiterated a Buy rating on the stock and raised the price target to $418 from $406. The new price target implies 9.3% upside potential from current level.

Lau is of the opinion that Moody’s Analytics generates about 40% of the total revenue, 93% of which is recurring. “The retention rate of Moody’s Analytics is about 95%; and Moody’s Analytics had been growing its revenue at low-double-digit, and expects to grow at mid-teen this year,” Lau added.

Overall, the stock has a Moderate Buy consensus based on 6 Buys and 5 Holds. The average Moody’s price target of $401.55 implies 5% upside potential to current levels. Shares of the company have gained nearly 28.6% over the past six months.

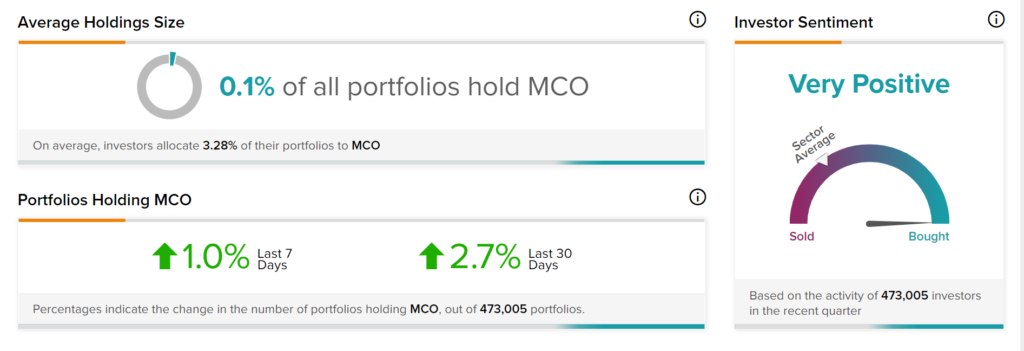

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Moody’s with 2.7% of investors on TipRanks increasing their exposure to MCO stock over the past 30 days.

Related News:

Albemarle Issues Long-Term Financial Targets

NXP Semiconductors Partners Tata Consultancy Services

Caterpillar Acquires CarbonPoint Solutions