Moody’s Analytics, Inc., a subsidiary of Moody’s Corporation (MCO), has introduced RiskIntegrity Investment Insight, an asset-liability management solution for insurance companies.

The tool seeks to combine data and modeling capabilities across Moody’s Analytics to support insurers in building liability-aware investment portfolios. Also, they will be able to effectively judge the performance of investment strategies across a range of business metrics.

Further, the tool is expected to help counter hurdles faced by insurance companies, i.e., managing their organization’s investment strategy, reducing the operational risk of maintaining complex data and models, and adapting to regulatory change. It is also expected to generate user-friendly analytics and reports on demand.

New investment strategies, aligned to specific objectives and risk profiles, can also be developed with this tool. (See Moody’s stock charts on TipRanks)

The Senior Director at Moody’s Analytics, Phil Mowbray, said, “Insurers are looking for control and visibility of the economic assumptions and scenarios embedded in their investment process. They need to be able to quickly assess the impact of investment decisions across a range of business metrics – economic, capital, and liquidity. RiskIntegrity Investment Insight will help insurers to perform strategic asset allocation, make better investment decisions, and take more control of their investment process.”

Price Target

Earlier this month, UBS analyst Alex Kramm maintained a Hold rating on Moody’s and raised the price target to $412 from $392. The new price target implies 5% upside potential from current level.

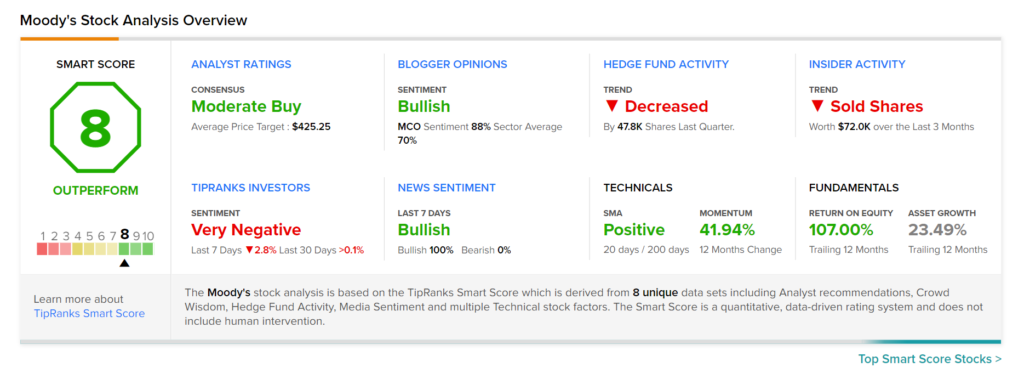

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 5 Buys and 3 Holds. The average Moody’s price target of $425.25 implies 8.3% upside potential.

Smart Score

MCO scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

See Top Smart Score Stocks on TipRanks >>

Related News:

5 Top E-Commerce Stocks

Cheniere Signs Long-Term LNG Sale and Purchase Deal with Foran

Health Canada Approves Johnson & Johnson’s COVID-19 Vaccine

Mastercard Acquires Arcus; Shares Rise