Monster Beverage stock (MNST) is currently trading at a notable discount, offering a compelling opportunity for investors to buy this quality compounder. The energy drink giant has rarely been available to investors at discounted multiples due to its consistent growth, strong profitability, and healthy balance sheet. However, its shares have faced a prolonged decline over the past year, driven by concerns over a potential growth slowdown. However, this slowdown doesn’t tell the whole story.

While these concerns have some basis, I believe they are overall exaggerated. In fact, I believe Monster’s current valuation appears attractive relative to its earnings growth prospects. Therefore, I am bullish on the MNST stock.

Is Monster’s Growth Actually Slowing Down?

First, I would like to address investors’ fears over Monster’s slowdown in growth. These concerns are not unfounded, as Monster’s Q2 revenue growth came in at just 2.5%, marking the weakest result in 16 quarters and sustaining the deceleration trend seen over the past three quarters. While this may initially seem alarming, I believe the situation is far from dire.

Specifically, the slower revenue growth compared to previous quarters can be attributed to factors outside the company’s control, such as foreign exchange headwinds, which negatively impacted net sales by approximately $67.7 million. In other words, net sales growth was 6.1% in constant currency. Moreover, economic challenges in certain regions, including Argentina, further skewed the overall growth figures. It’s necessary to stress that when stripping out the impact of these external factors, Monster’s core business continues to exhibit strong performance, particularly in key markets.

In particular, despite a more challenging consumer environment and reduced foot traffic in convenience stores, Monster’s global footprint allowed it to maintain growth momentum, even if that was at a softer pace. Notably, net sales in Latin America surged by 14.1%, driven by strong performances in Brazil and Mexico. Furthermore, the company’s expansion in non-Nielsen-measured channels (Nielsen is a global data and analytics company that tracks consumer behavior and market trends) and product launches across various markets continued to support sales growth in multiple markets.

Overcoming Slow Growth in the past

It’s important to remind the readers that Monster has experienced several periods of slowed growth over the years due to industry dynamics, yet these have not affected its long-term trajectory. For example, in Q2 2020, Monster’s sales dipped by 0.9%, and in Q2 2015, revenue growth declined by just under 1%.

However, the company has consistently rebounded from these temporary setbacks, as evident in its Last-12-Month (LTM) revenue growth CAGR leading up to Q2, which stands at an impressive 12.11%. This track record supports the idea that there is no cause for concern over the seemingly weak recent quarter.

Robust Margins and Profitability Despite Revenue Moderation

Another crucial aspect that supports the bullish sentiment is Monster’s strong profitability, even with moderation in revenue growth (though not due to troubling factors). Monster’s gross margin increased to 53.6%, up from 52.5% in the previous year, thanks to lower freight costs, successful pricing actions, and reduced aluminum costs. Consequently, net income rose by a slightly above-revenue 2.8% to $425.4 million, while earnings per share advanced by about 5% to $0.41, further aided by a lower share count due to Monster’s share repurchases.

The Valuation Is Compelling At Current Levels

Any way you look at it, Monster’s valuation at this moment in time is attractive. Current consensus estimates suggest an EPS of $1.69 for FY2024, representing a solid 10% year-over-year growth. Remarkably, the company is poised to achieve double-digit EPS growth in what many are considering a slowdown year. Moreover, while the projected P/E ratio of nearly 28 might seem high at first glance, it’s important to note two key points:

First, this is still notably lower than the company’s historical valuation, and second, this multiple represents a substantial discount considering that Wall Street expects double-digit EPS growth to continue well into 2029.

Monster Aggressively Buying Back Shares

It is not just investors looking to take advantage of the rare discount. MNST is trying to achieve exactly that with its efforts to buy back shares and capitalize on that discount aggressively. More specifically, on June 10th, Monster completed a $3.0 billion Dutch auction tender offer, buying 56.6 million shares at $53 each. Furthermore, from April to June 2024, Monster bought back 2.2 million shares at $49.55 each and an additional 3.9 million at $49.59 each.

As of August 6th, when the company released its Q2 report, $342.4 million remained available for further buybacks. Then, on August 19th, the company authorized an additional $500 million buyback program. That’s only two weeks, but it indicates an aggressive continuation of its stock repurchase strategy at the stock’s current levels.

Is MNST Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Monster Beverage features a Moderate Buy consensus rating based on 10 Buys, six Holds, and two Sells assigned in the past three months. At $53.19, the average MNST stock forecast suggests a 12.5% upside potential.

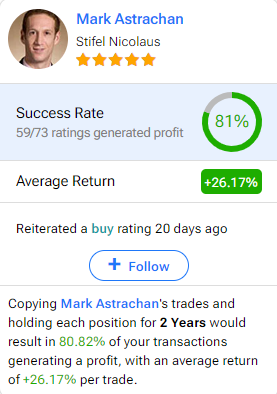

If you’re uncertain about which analyst to follow for buying and selling MNST stock, consider Mark Astrachan from Stifel Nicolaus, a five-star analyst according to Tipranks’ ratings. Over the past year, he has been the most profitable analyst covering this stock, delivering an average return of 26.17% per rating with a 71% success rate. Click on the image below to learn more.

Takeaway

When looking from a distance at Monster Beverage stock’s slow growth, it might seem worrying. However, after taking a closer look from a different angle, the picture becomes clearer and far more optimistic. MSNT offers a compelling buying opportunity as it trades at a discount despite its consistent growth track record and bright outlook.

While recent revenue growth concerns caused by external factors have impacted investors’ sentiment, the company’s underlying performance remains robust. With continued profitability, aggressive share buybacks, and an attractive valuation relative to Wall Street’s EPS growth estimates, Monster’s investment case remains highly attractive. Therefore, I am bullish on MSNT stock.