General-purpose software service platform MongoDB, Inc. (MDB) delivered robust third-quarter results, with lower-than-feared loss and solid revenue beat. Following the news, shares surged 17.9% during the extended trading session on December 6.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Robust Results

The company’s robust results were backed by an 84% year-over-year revenue growth in its MongoDB Atlas segment, a major revenue generator for the company. The company also surpassed 31,000 customers at quarter-end and provided upbeat guidance.

The company posted a quarterly loss of 11 cents per share, much lower than the analysts’ estimated loss of 37 cents per share. In the prior-year quarter, MDB posted a quarterly loss of 31 cents per share.

Similarly, total revenue climbed 50% year-over-year to $226.89 million, surpassing analysts’ estimates of $205.14 million. The strong revenue growth was driven by a 51% year-over-year increase in subscription revenue.

Management Comments

President and CEO of MongoDB, Dev Ittycheria, said, “We believe a key driver of our success has been the early, but growing, trend of customers choosing MongoDB as an enterprise standard for their future application development. Our success across industries and a wide variety of use cases puts us in a great position to build even deeper relationships with our customers over time.”

See Analysts’ Top Stocks on TipRanks >>

Guidance

Based on the continued business momentum, MongoDB forecasts fourth-quarter revenue to fall in the range of $239 million to $242 million, significantly higher than the consensus estimate of $227.7 million.

Additionally, MDB expects Q4 loss to be between $0.24 per share to $0.21 per share, much lower than the consensus-estimated loss of $0.34 per share.

Moreover, MongoDB projects full-year fiscal 2022 revenue and quarterly loss to fall in the range of $846.3 million to $849.3 million and $0.74 per share to $0.71 per share, respectively.

Analysts’ Take

Responding to MongoDB’s quarterly performance, JMP Securities analyst Patrick Walravens maintained a Hold rating on the stock.

Walravens noted that MDB results beat estimates and also gave guidance that was better than expected. The analyst said, “We believe MongoDB’s current valuation fairly captures the impressive growth in this business.”

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 2 Holds. The average MongoDB price target of $585.67 implies 36.41% upside potential to current levels. Shares have gained 53.1% over the past year.

Blogger Opinion

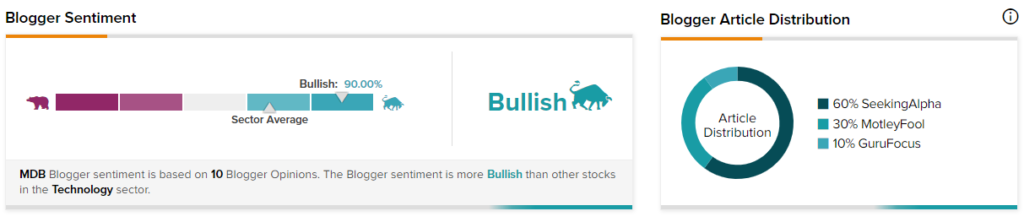

TipRanks data shows that financial blogger opinions are 90% Bullish on MDB, compared to a sector average of 67%.

Related News:

Kohl’s Shares Up as Investor Urges Business Split

Spotify Removes Comedians Work Amid Royalty Dispute

Big Lots Posts Better-Than-Expected Q3 Results; Shares Up 5%