Cross-border P2P payments and money transfer company MoneyGram International, Inc. (NASDAQ:MGI) announced that it has entered into a partnership with Paytm Payments Bank, an Indian payments bank, to enable smooth money transfer.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Following the news, shares of the company declined 1.5% during yesterday’s trading session. However, it pared some of its losses to close at $7.97 in the extended trade.

Strategic Impact

With this partnership, MoneyGram customers can send money in near real-time, directly to the millions of fully KYC-compliant Paytm Wallets in India from anywhere in the world.

Furthermore, with the burgeoning digital payments scenario in India, MoneyGram expects to grow rapidly and this partnership is likely to be an enabler in this aim.

Management Commentary

CEO of MoneyGram, Alex Holmes, said “We’re thrilled to partner with Paytm Payments Bank to expand our mobile wallet capabilities into one of the largest receive markets in the world. As consumer preference in India and beyond shifts toward receiving transfers digitally, MoneyGram is well-positioned to continue to meet demand.”

See Top Smart Score Stocks on TipRanks >>

Analyst Ratings

Consensus among analysts is a Moderate Sell based on 1 Hold and 1 Sell. The average MoneyGram price target of $6 implies downside potential of 24.1% from current levels. However, shares have gained 31% over the past year.

TipRanks Website Traffic

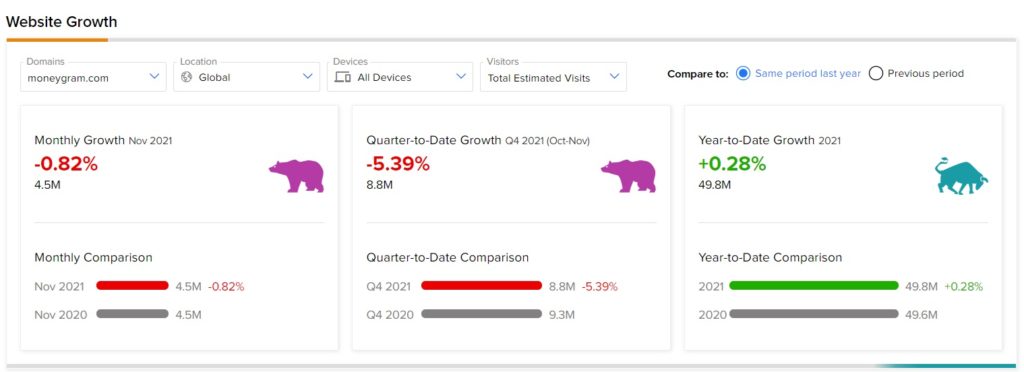

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into MoneyGram’s performance this quarter.

According to the tool, the MoneyGram website recorded a 0.82% monthly fall in global visits in November, compared to the same period last year. However, year-to-date, website traffic rose 0.28%, compared to the previous year.

Related News:

Dye & Durham to Buy Link Group; Shares Pop

BlackBerry Q3 Beats Estimates, Shares Plunge

Zynga Partners With Forte; Street Says Buy