UK-based Mondi PLC (GB:MNDI) has agreed to acquire key businesses from German manufacturer Schumacher GmbH in a move to expand its packaging power in Europe. Under the agreement, Mondi is acquiring Schumacher’s corrugated converting and solid board operations in Germany, Benelux, and the UK for an enterprise value of €634 million. Mondi shares gained 4.6% as of writing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Mondi PLC is a leading manufacturing company that specializes in the production and distribution of pulp, paper, and flexible plastic packaging products.

Mondi Strengthens Packaging Footprint with Strategic Acquisition

This acquisition strengthens Mondi’s presence in Western Europe with complementary assets, boosting capacity by more than 1 billion square meters. The acquisition includes seven corrugated converting plants, two solid board mills, and four solid board converting facilities.

Furthermore, the acquisition aligns with Mondi’s strategy to grow its Corrugated Packaging business in Europe and nearby markets. Under this strategy, the company aims to invest in cost-effective assets and better integrate operations to ensure a reliable supply for customers and improve efficiency.

Mondi stated that it will finance the acquisition using its current bank facilities and expects the deal to enhance EPS (earnings per share) in the first full financial year after completion. The transaction is expected to close in the first half of 2025, pending regulatory approval.

Is Mondi a Good Stock to Buy?

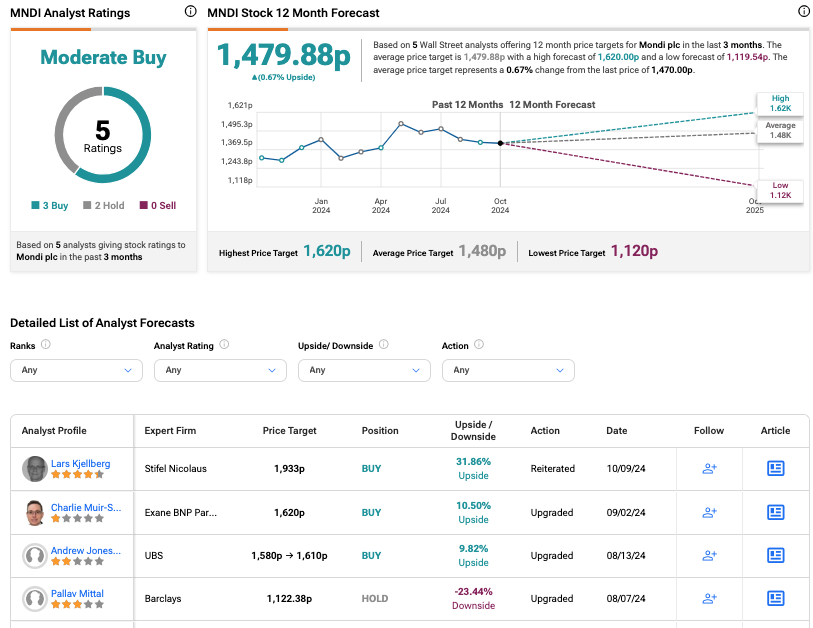

According to TipRanks consensus, MNDI stock has received a Moderate Buy rating based on three Buy and two Hold recommendations. The Mondi share price target is 1,479.88p, which is almost similar to current trading levels.