The casino hotel industry was hard hit by the pandemic. According to IBISWorld, the industry’s revenue decreased at a compound annual growth rate (CAGR) of 0.8% over the past five years. However, unlike the industry average, Monarch Casino & Resort (NASDAQ:MCRI) has successfully managed to navigate a challenging environment, and the stock is up 68.8% over the past five years. As such, investors looking for a “steady Eddy” investment with potential upside might want to consider this stock.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Monarch’s Casinos & Resorts

Monarch Casino & Resort is a hospitality and entertainment company that operates through its subsidiaries. Significant assets under its ownership include the Atlantis Casino Resort Spa in Reno, Nevada, and the Monarch Casino Resort Spa in Black Hawk, Colorado. Both facilities encompass a hotel and casino, providing their patronage with a full suite of leisure and entertainment services.

Atlantis encompasses about 61,000 square feet of casino space, offering 817 rooms, eight food outlets, a 30,000-square-foot wellness arena, a retail outlet with traditional gifts and clothing, and a family entertainment center covering 8,000 square feet. It is packed with roughly 1,200 slot and video poker machines, 33 table games like blackjack, craps, roulette, a race and sports book, a live keno lounge, and a poker room. Additionally, it boasts about 52,000 square feet of event and meeting spaces.

Monarch Black Hawk is about 60,000 square feet and features around 1,000 slot machines, 43 table games, a live poker room, keno, and a sports book. The resort also houses 10 bars, four dining facilities, and 516 guest rooms, alongside banquet spaces, a store, a concierge lounge, a spa, and a year-round pool.

Monarch’s Recent Financial Results

The company recently reported Q1-2024 financial results. Both net revenue and adjusted EBITDA set record highs for the first quarter. However, the company’s net income and diluted EPS fell short of expectations, with revenue coming in at $121.7 million compared to the consensus forecast of $122.22 million and diluted EPS of $0.93 missing expectations of $0.99 per share.

Monarch reported $39.5 million in cash and cash equivalents on its balance sheet as of March 31, 2024. The company also had an outstanding principal balance of $5.5 million under its credit facility.

Management has maintained a focus on unlocking value for shareholders. It announced a cash dividend of $0.30 per share, payable on June 15, 2024, and purchased 281,708 shares of its common stock on the open market during the first quarter for an aggregate amount of $19.4 million.

Is MCRI Stock a Buy, According to Analysts?

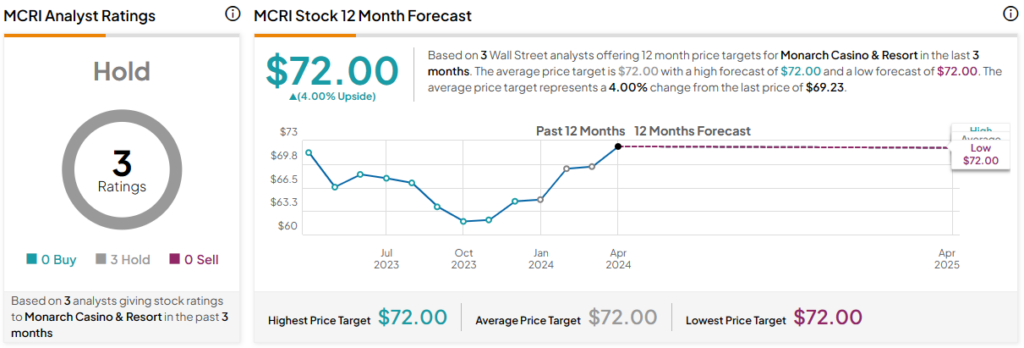

Analysts following MCRI have taken a cautious stand on the stock. For instance, Macquarie analyst Chad Beynon recently issued a Hold recommendation based on moderating organic growth on the stock. However, given the firm’s robust balance sheet, he suggests that it is poised for potential growth through mergers and acquisitions.

Monarch Casino & Resort is rated a Hold based on the recommendations and 12-month price targets assigned by three analysts in the past three months. The average price target for MCRI stock is $72.00, which represents 4% upside potential from current levels.

Nonetheless, MCRI stock has been trending down recently, losing 5.3% in the past month. It trades in the middle of its 52-week price range of $56.25-$75.40 and continues to demonstrate negative price momentum.

The Bottom Line on MCRI Stock

Monarch Casino & Resort successfully weathered a challenging few years when the casino hotel industry suffered a significant revenue decrease, showcasing the company’s resilience and potential as an investment opportunity. While the stock has been on a downward trend recently, the company’s steady performance and potential for growth through acquisitions could make it an intriguing option for income-oriented investors.