When it comes to stocks, there are few words investors like better than the simple, blessed phrase “stock buyback.” Proving that point is Mogo Finance Technologies (TSE:MOGO) (NASDAQ:MOGO), which gained over 3% in Tuesday afternoon’s trading thanks to exactly that principle.

Mogo brass revealed that it bought back 474,353 shares of its stock in 2023. It also canceled the shares it bought back, which means fewer total shares and a less diluted ownership structure. Over the last three years, meanwhile, that figure swelled up to 1,074,353—about 4.4% of its total outstanding shares—as it bought back 600,000 shares through its NASDAQ operations in 2022. It has a total of 24.5 million shares outstanding and issued overall.

Further Developments Await

While this was the big news for the day from Mogo—which wasn’t half bad, based on the impact on its share price alone—that was far from all it’s got going on lately. Mogo has been working with Oracle Cloud to augment its reach, using the system as the basis not only for MogoTrade, its stock trading arm but also for Moka, a flat-fee investing operation. Mogo also works with Flash Forest, which works to plant trees in areas designated “high severity burn zones.” So far, the duo has planted over 300,000 trees, which should make Mogo an attractive play in the ESG investment market as well.

Is Mogo a Good Stock to Buy?

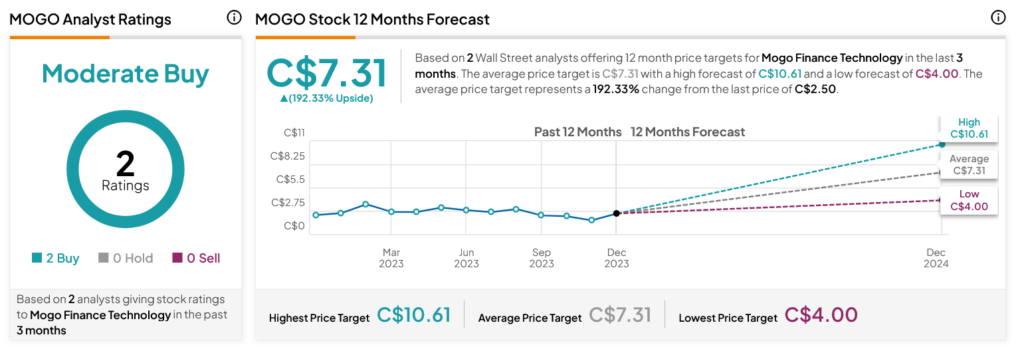

Turning to Wall Street, analysts have a Moderate Buy consensus rating on MOGO stock based on two Buys assigned in the past three months, as indicated by the graphic below. After an 8.23% rally in its share price over the past year, the average MOGO price target of C$7.31 per share implies 192.33% upside potential.