Shares of American pharmaceutical and biotechnology company Moderna, Inc. (NASDAQ: MRNA) rose 9.3% to close at $233.70 on Monday after the company provided updates on its mRNA pipeline.

Moderna is currently working on 40 development programs, including 23 ongoing clinical studies encompassing mRNA infectious disease vaccines and mRNA therapeutics spanning seven different modalities.

CEO Comments

The CEO of Moderna, Stephane Bancel, said, “2021 was a year of incredible impact and growth for Moderna. Because of our many years of investment in mRNA technology we were ready to develop and launch our Covid-19 vaccine which helped millions of people around the world. We have delivered 807 million doses with approximately 25% of those doses going to low- and middle-income countries and we will continue to scale in 2022 to help end the COVID-19 pandemic.”

“We will continue to advance mRNA vaccines that can have a profound impact on health and quality of life including vaccines against respiratory viruses with the goal of bringing to market a pan-respiratory annual customizable booster vaccine. In parallel, we are advancing first-in-class vaccines against latent viruses, which remain in the body for life and can cause lifelong medical conditions and we are also working to bring to market therapeutics based on mRNA-encoded proteins to help address multiple disease areas. We look forward to further leveraging our mRNA technology and delivery into gene-editing and other ways to impact human health,” Bancel added.

Pipeline Update

The company is developing an Omicron-containing booster vaccine candidate called mRNA-1273.529, which is expected to undergo clinical trials in early 2022. Notably, booster doses of the company’s current COVID-19 vaccine, mRNA-1273, at both 50 microgram and 100 microgram dose levels, have increased neutralizing antibody levels against Omicron, the company said.

Markedly, Moderna will build a state-of-the-art mRNA facility in Africa to ensure access to mRNA vaccines in future pandemics.

Advanced Purchase Agreements (APAs)

For 2022, Moderna has inked APAs for product sales of about $18.5 billion (up from $17 billion announced in November 2021) and around $3.5 billion in options contracts, which includes any potential updated COVID-19 vaccine booster candidates. Notably, Moderna is in discussions for additional COVID-19 vaccine contracts in 2022.

Other Developments

Moderna inked a strategic collaboration agreement with Carisma Therapeutics Inc., a biopharmaceutical company, to discover, develop, and commercialize in vivo engineered chimeric antigen receptor monocyte (CAR-M) therapeutics for the treatment of cancer.

Per the terms, Carisma will receive an upfront cash payment of $45 million, and Moderna will invest $35 million in the convertible notes of Carisma. Additionally, Carisma is eligible to receive milestone payments, plus royalties on net sales of any products commercialized under the agreement.

Wall Street’s Take

Yesterday, Brookline Capital Markets analyst Leah R. Cann reiterated a Buy rating and a price target of $506 (116.52% upside potential) on the stock.

Cann said, “We believe the COVID-19 franchise is being undervalued by approximately 35%, and we estimate Moderna’s clinical-stage pipeline should add 11% to the valuation on top of the COVID-19 franchise, and of most interest to us, is the late-stage preclinical pipeline that we calculate adds another 38% to the combined value of the COVID-19 franchise and the clinical-stage pipeline.”

Overall, the stock has a Hold consensus rating based on 7 Buys, 6 Holds, and 3 Sells. The average Moderna price target of $317.69 implies 35.94% upside potential from current levels. Shares have gained 87.6% over the past year.

Risk Analysis

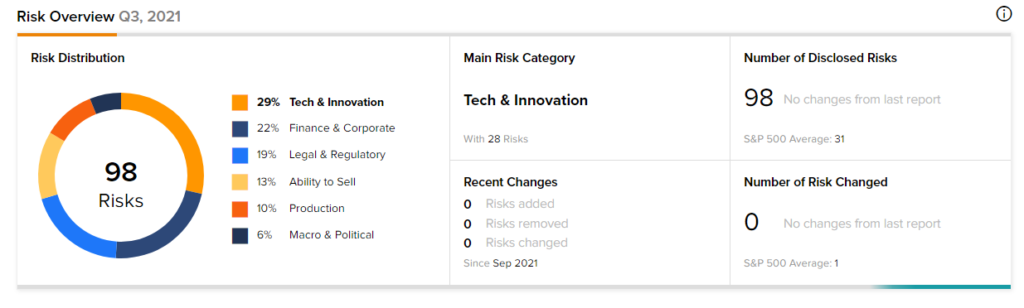

According to the new TipRanks Risk Factors tool, Moderna stock is at risk mainly from three factors: Tech and Innovation, Finance and Corporate, and Legal and Regulatory, which contribute 29%, 22%, and 19%, respectively, to the total 98 risks identified for the stock.

Download the TipRanks mobile app now

Related News:

Ocugen Reveals Positive Results from Phase 2 Analysis of COVAXIN

FedEx Operations Affected by Omicron & Bad Weather – Report

Bank of America to Reward Employees with Higher Bonuses – Report

Questions or Comments about the article? Write to editor@tipranks.com