Biotech stocks like Moderna (NASDAQ:MRNA) often flourish under specific conditions, such as receiving regulatory approval for their drugs. Recently, the EU’s main regulatory agency recommended granting Moderna marketing rights for its new COVID-19 vaccine, propelling its stock to surge over 4% at the time of writing.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

With the approval of Moderna’s new COVID-19 vaccine, produced with the XBB.1.5 variant of Omicron in mind, European authorities can add the treatment to their standard fall/winter 2023 immunization campaigns. The vaccine, known as Spikevax, is set for use in those six months old or older. It also has been shown effective against several other subvariants, including XBB 1.5, 1.16, 2.3.2, and the BA.2.86 version.

Yet, even as Moderna rolls out new products, it’s also dropping some older ones. It’s dropping four of its “clinical assets” from the pipeline, including two that AstraZeneca (NASDAQ:AZN) dropped last year. Among the assets to be dropped were a treatment for heart patients known as AZD8601, and a cancer treatment, MEDI1191, which was used in conjunction with Imfinzi to target solid tumors. Some of the items dropped didn’t quite have the desired impact, while others seemed to fare well in testing, making their removal a mystery.

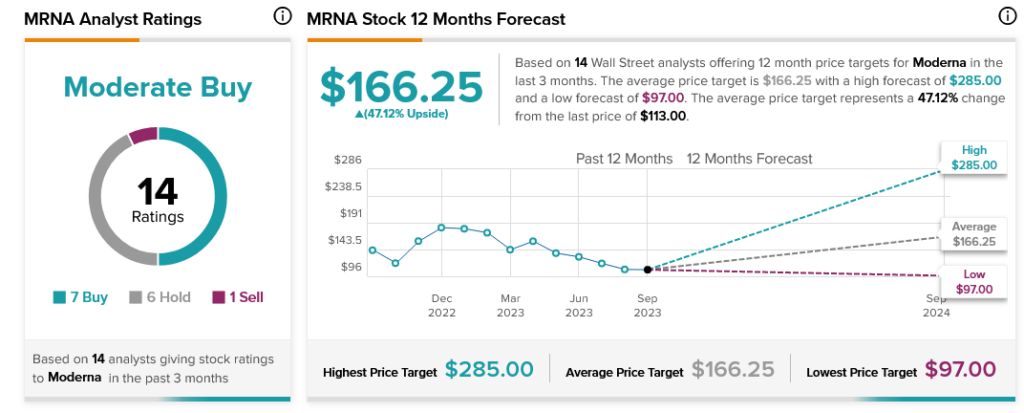

Meanwhile, Moderna is holding up well with analysts. With seven Buy ratings, six Holds, and one Sell, Moderna stock is considered a Moderate Buy. Further, with an average price target of $166.25, Moderna stock offers investors 47.12% upside potential.