MicroStrategy (MSTR) is gearing up to join the Nasdaq-100 on December 23, a major milestone for the company. Now many are wondering about its potential inclusion in the S&P 500. According to a report from Benchmark, while MicroStrategy checks most of the boxes for S&P 500 eligibility, it still needs to report positive earnings for both the latest quarter and the sum of the last four quarters.

FASB Changes Could Unlock S&P 500 Opportunity

The company has a plan in place, though. MicroStrategy is set to adopt new Financial Accounting Standards Board (FASB) guidance for Bitcoin accounting in early 2025, which would position it to report positive earnings. This could be the key to meeting the remaining S&P 500 requirements.

Big ETFs Could Supercharge MicroStrategy’s Growth

Joining the S&P 500 would have a massive impact, especially when you look at what happened to Tesla’s stock after its inclusion in 2020. CoinDesk notes that MicroStrategy’s stock could experience similar momentum, thanks to the massive influence of top ETFs that track the S&P 500. The company’s Bitcoin holdings make this even more intriguing.

Is MicroStrategy a Buy Right Now?

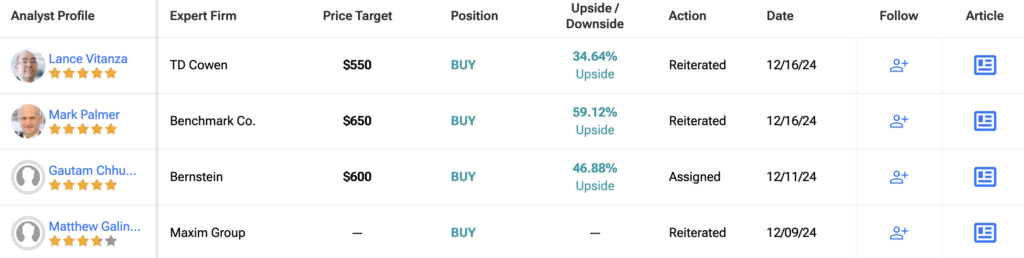

Analysts remain optimistic about MSTR stock, with a Strong Buy consensus rating based on a unanimous eight Buys. Over the past year, MSTR has increased by more than 610%, and the average MSTR price target of $529.57 implies an upside potential of 29.6% from current levels.