MicroStrategy (MSTR), led by Michael Saylor, is rewriting the financial playbook by issuing convertible notes to fund massive Bitcoin purchases. According to CoinDesk, the company has raised $6 billion using this method and plans to add another $18 billion over the next three years. Their Bitcoin stash now stands at a jaw-dropping 439,000 tokens, worth $46 billion as of December 15.

Raising Debt Without the Usual Strings

Convertible notes, unlike traditional loans, don’t require collateral and offer investors both downside protection and upside potential. MicroStrategy has issued these notes with remarkably low or even zero interest rates—a move that experts attribute to the volatility of its stock, which is heavily tied to Bitcoin. Richard Byworth, a partner at Syz Capital, told the On The Margin podcast, “This stuff is whipping around like crazy,” emphasizing the intense market activity surrounding these notes.

Risks Lurk Beneath the Strategy

While the strategy seems genius in a bull market, it has risks. If Bitcoin’s price drops significantly for a prolonged period, companies like MicroStrategy may face pressure to sell assets or issue equity, diluting shareholder value. Quinn Thompson from Lekker Capital told CoinDesk that such a downturn could lead to “selling Bitcoin for less than they bought it.”

MicroStrategy’s high-wire act has inspired imitators like Marathon Digital Holdings (MARA) and Bitdeer (BTDR). But as history shows, no strategy is risk-free—especially when it’s tied to Bitcoin’s notorious volatility.

Is MSTR Stock a Good Buy?

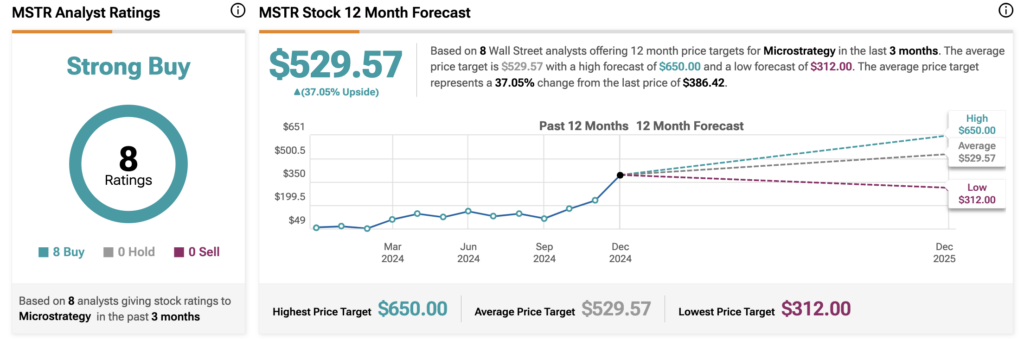

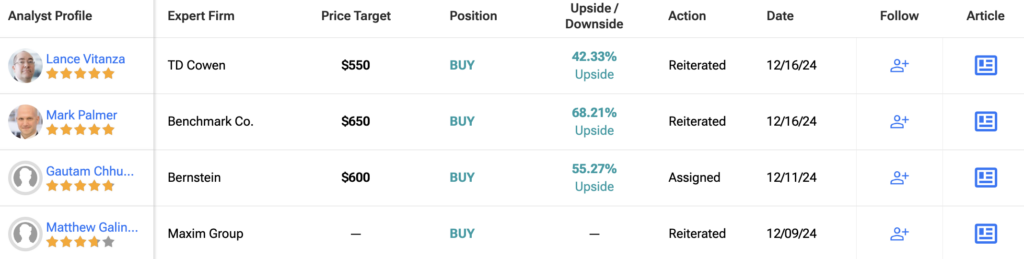

Analysts remain optimistic about MSTR stock, with a Strong Buy consensus rating based on a unanimous eight Buys. Over the past year, MSTR has increased by more than 570%, and the average MSTR price target of $529.57 implies an upside potential of 37.05% from current levels.

Questions or Comments about the article? Write to editor@tipranks.com