MicroStrategy’s bullish options skew vanishes as cautious sentiment rises, with shares down 44% amid fading Bitcoin momentum.

Market News

MicroStrategy’s Bullish Skew Vanishes as Bitcoin Momentum Fades

Story Highlights

MicroStrategy (MSTR), once a darling for traders betting on Bitcoin’s upside, has hit a rough patch. The company’s bullish options skew, which reflects a preference for upside bets, has disappeared. This shows that the market is becoming more cautious, according to Market Chameleon.

Options Data Signals Neutral Sentiment

MicroStrategy’s 250-day put-call skew, which tracks the difference in demand for Call (Buy) and Put (Sell) options, has leveled out at zero. Just three weeks ago, calls were trading at a hefty premium, reflecting high hopes for MSTR’s rally potential. Now, that optimism has evaporated.

MSTR Share Price Tumbles

The shift comes as MicroStrategy’s share price plummeted 44% from its $589 peak on November 21, now sitting at $289. Despite its massive Bitcoin holdings of 446,400 BTC, equivalent to $42.6 billion, MSTR has underperformed Bitcoin itself. While Bitcoin dipped just 3% in December, MicroStrategy fell a staggering 25%.

Bitcoin Narrative Loses Steam

Markus Thielen of 10x Research explained the trend, saying, “The Bitcoin tailwind generated by this narrative appears to be losing steam.” Investors seem less willing to pay a premium for MSTR’s Bitcoin exposure, especially when they can buy Bitcoin directly at a lower cost.

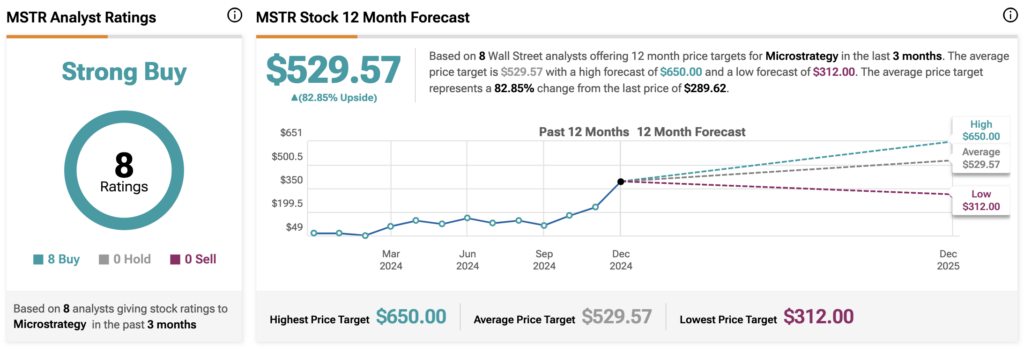

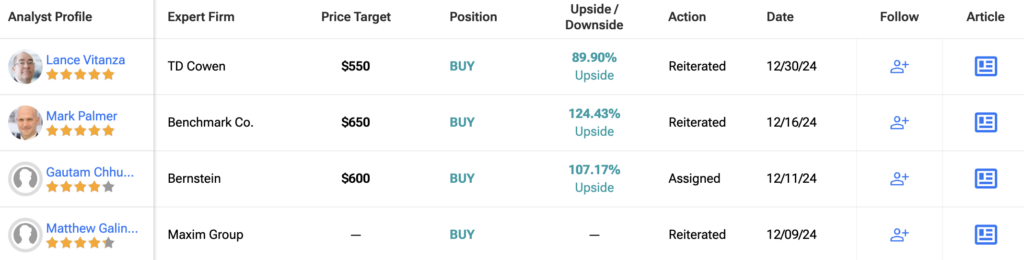

Is MSTR Stock a Good Buy?

Analysts remain optimistic about MSTR stock, with a Strong Buy consensus rating based on a unanimous eight Buys. Over the past year, MSTR has increased by more than 320%, and the average MSTR price target of $529.57 implies an upside potential of 82.9% from current levels.

Questions or Comments about the article? Write to editor@tipranks.com