Software company turned crypto acquirer MicroStrategy (MSTR) has increased its Bitcoin (BTC-USD) holdings again, purchasing 21,550 BTC for about $2.1 billion last week. The transaction was made at an average price of approximately $98,783 per coin, marking the company’s fifth consecutive week of bitcoin acquisitions.

To fund this latest purchase, MicroStrategy issued $2.13 billion worth of its shares. This sale was part of MSTR’s $42 billion plan, announced in October, to acquire Bitcoin through equity and convertible note offerings. With this latest acquisition, the company’s total Bitcoin holdings rose to nearly 423,650 BTC, valued at about $41.5 billion at the current price.

MicroStrategy’s Bitcoin Strategy Faces Volatility Risks

MicroStrategy’s continued investment in Bitcoin highlights its belief in the long-term potential of the cryptocurrency. Moreover, Bitcoin has rallied significantly since the re-election of Donald Trump, driven by optimism around a more crypto-friendly regulatory environment.

However, the company’s stock price has been volatile, reflecting Bitcoin’s price fluctuations. Also, MSTR’s strategy of raising Bitcoin holdings has raised concerns about its financial health, as it relies heavily on the performance of the cryptocurrency. A significant decline in Bitcoin’s price could impact MicroStrategy’s financial stability.

Top Analyst Remains Bullish on MSTR Stock

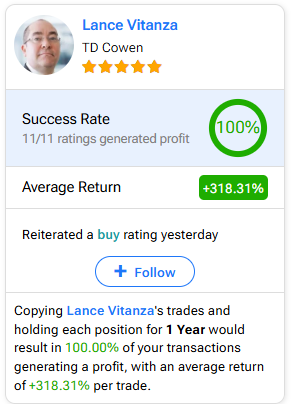

A top-rated analyst from TD Cowen, Lance Vitanza, maintained a Buy rating on MicroStrategy, citing the company’s strategic investment in Bitcoin as a key factor driving shareholder value. Investors should note that Vitanza is both the Most Accurate and Most Profitable analyst covering MSTR stock.

Over the past year, he has had a 100% success rate on the stock and has earned average returns of 318.31% in the said period (To see Vitanza’s track record, click here).

Is MSTR Stock a Good Buy?

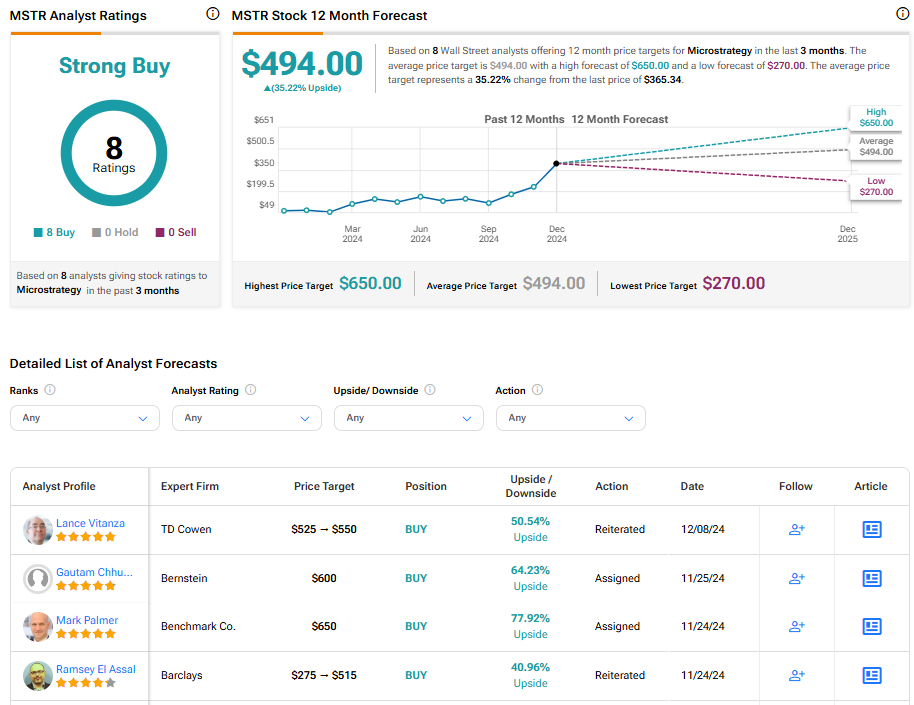

Turning to Wall Street, MSTR stock has a Strong Buy consensus rating based on eight unanimous Buys assigned in the last three months. At $494, the average MicroStrategy price target implies a 35.22% upside potential. Shares of the company have gained a massive 478.44% year-to-date.