Software company turned crypto acquirer MicroStategy (MSTR) has purchased an additional 51,780 Bitcoin (BTC) valued at $4.67 billion over the past seven days.

A little more than a week ago, MicroStrategy purchased 27,200 Bitcoin for $2.45 billion. That brings the company’s total Bitcoin purchases over the past few weeks to 78,980 worth $7.10 billion. The current buying spree comes as crypto enjoys a post-election rally in the U.S.

With its latest purchase, MicroStrategy, which first began acquiring Bitcoin in 2020, now owns 331,200 of the digital tokens worth about $30 billion based on BTC’s current price of around $90,000. MicroStrategy, which is led by Executive Chairman Michael Saylor, is the world’s largest corporate holder of Bitcoin.

Raising Capital

To fund its latest Bitcoin purchase, MicroStrategy sold 13.6 million of its own stock and raised $4.60 billion. The company has an additional $15.30 billion of stock that it can sell under a current plan to purchase even more Bitcoin.

Michael Saylor took to social media to announce the company’s latest Bitcoin purchase and reiterate his bullish outlook for the crypto market. MicroStrategy’s stock has been on a tear this year, having gained 467%.

Is MSTR Stock a Buy?

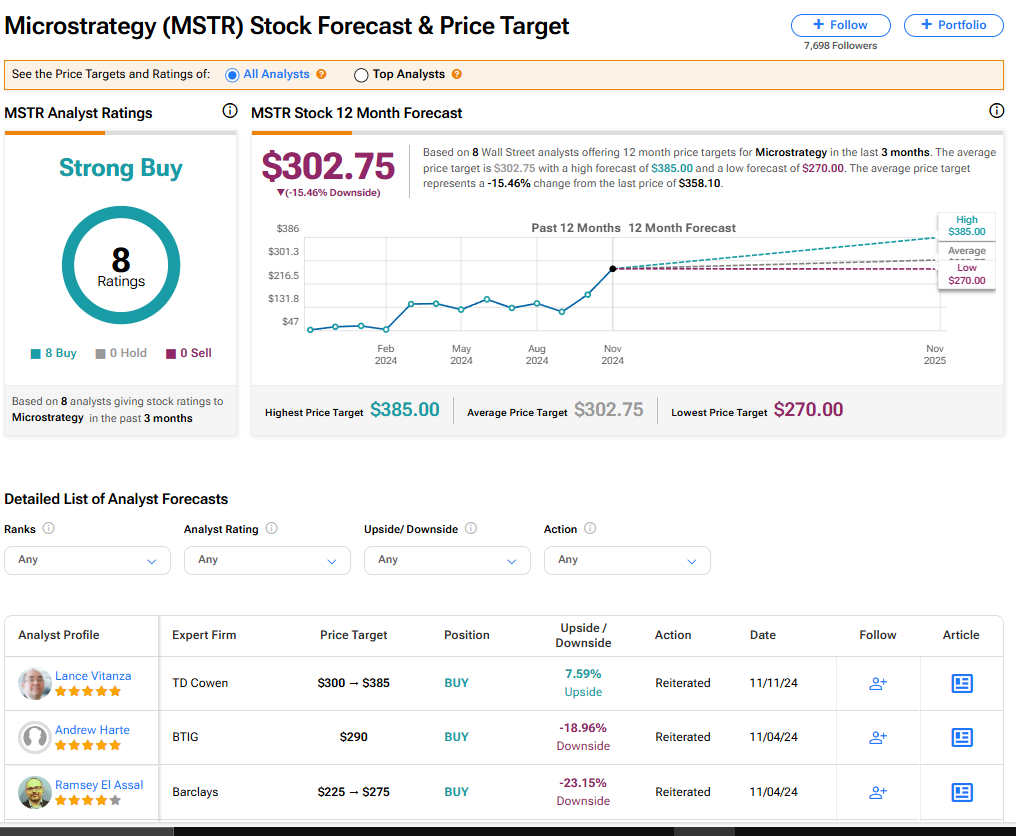

The stock of MicroStrategy currently has a consensus Strong Buy rating among eight Wall Street analysts. That rating is based on eight Buy recommendations issued in the past three months. There are no Hold or Sell ratings on the stock. The average MSTR price target of $302.75 implies 15.46% downside risk from current levels.

Read more analyst ratings on MSTR stock

Questions or Comments about the article? Write to editor@tipranks.com