MicroStrategy (MSTR), under the leadership of Michael Saylor, continues its relentless Bitcoin acquisition streak. For the tenth consecutive week, the company added 2,530 Bitcoin, bringing its total holdings to an impressive 450,000 BTC. These tokens were purchased for $243 million, at an average price of $95,972 per Bitcoin. This is a slight increase from the overall average purchase price of $62,691, according to Cointelegraph.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Market Volatility Sparks Concern

As MicroStrategy bolsters its Bitcoin stack, the company’s shares are feeling the strain. In premarket trading, shares are down nearly 5%, mirroring the recent drop in Bitcoin’s price, which now hovers just above $90,000. This volatility highlights the challenges faced by long-term Bitcoin investors, who must navigate through price swings alongside their strategic accumulation.

Semler Scientific Joins Bitcoin Buying Spree

Additionally, Semler Scientific (SMLR) has also jumped on the Bitcoin bandwagon, acquiring 237 BTC for $23.3 million, at an average price of $98,267 per coin. Like MicroStrategy, Semler’s move showcases the increasing adoption of Bitcoin as a strategic asset by corporations.

Is MicroStrategy a Buy, Hold, or Sell?

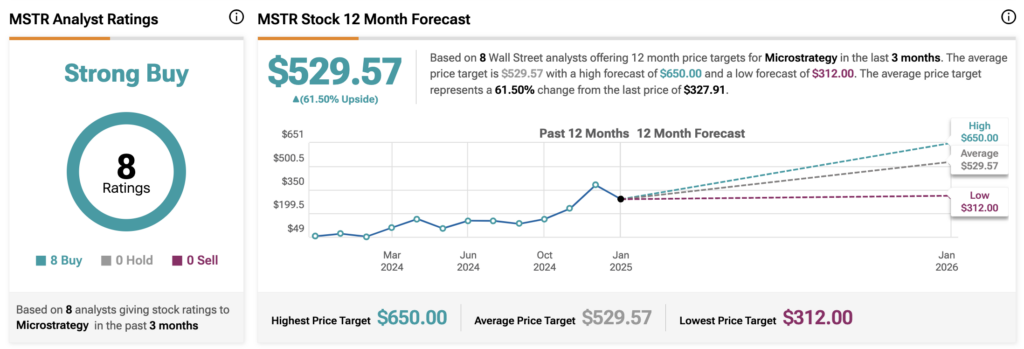

Analysts remain optimistic about MSTR stock, with a Strong Buy consensus rating based on a unanimous eight Buys. Over the past year, MSTR has increased by more than 550%, and the average MSTR price target of $529.57 implies an upside potential of 61.5% from current levels.