Microsoft Corp. (NASDAQ: MSFT) reported strong fiscal second-quarter 2022 results, topping analysts’ expectations. Showing particular strength were its Cloud, Gaming, and Windows Software segments. Additionally, the company provided strong guidance for the March quarter.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Following the news, shares of the tech giant rose 1.2% in Tuesday’s extended trading session after closing 2.7% lower on the day.

Results in Detail

Microsoft reported Q2 adjusted earnings of $2.48 per share, up 22% year-over-year, and comfortably beat the Street estimates of $2.31 per share.

Additionally, revenue advanced 20% to $51.7 billion and surpassed analysts’ expectations of $50.88 billion.

Segmental Revenues

Microsoft reported Productivity and Business Processes revenue of $15.9 billion in the quarter, up 19% year-over-year. Within the segment, Commercial cloud revenue rose 14%, Consumer cloud revenue grew 15%, and LinkedIn revenue surged 37%. Notably, Microsoft 365 Consumer subscribers grew to 56.4 million in the quarter.

Intelligent Cloud revenue came in at $18.3 billion, up 26%. Notably, Azure and other cloud services revenue growth was 46%. Microsoft Cloud revenue was up 32%, driven by long-term Azure commitments resulting in strong bookings.

More Personal Computing surged 15% to $17.5 billion, including a rise of 25% in Windows OEM revenue. A strong PC market, mainly in the commercial segment, drove the results.

Capital Deployment

During the second quarter, Microsoft returned $10.9 billion to shareholders in the form of share repurchases and dividends.

CEO’s Comments

Sharing his thoughts, Microsoft CEO Satya Nadella commented, “Digital technology is the most malleable resource at the world’s disposal to overcome constraints and reimagine everyday work and life. As tech as a percentage of global GDP continues to increase, we are innovating and investing across diverse and growing markets, with a common underlying technology stack and an operating model that reinforces a common strategy, culture, and sense of purpose.”

Guidance

For the Fiscal third quarter of 2022, the company has provided encouraging segmental revenue forecasts but expects the impact of foreign currency to decrease total revenue growth by around 2 points.

Productivity and Business Processes unit is expected to report revenue in the range of $15.6-$15.85 billion, while Intelligent Cloud revenue is expected to land between $18.75 billion and $19 billion.

Additionally, More Personal Computing unit revenue is forecast to come in between $14.15 billion and $14.45 billion.

Wall Street’s Take

Following the recent MSFT earnings report, Wedbush analyst Daniel Ives reiterated a Buy rating and a price target of $375 (30% upside potential) on the stock.

Ives believes “the underlying metrics and implied growth trajectory into the rest of 2022 is strong for MSFT.”

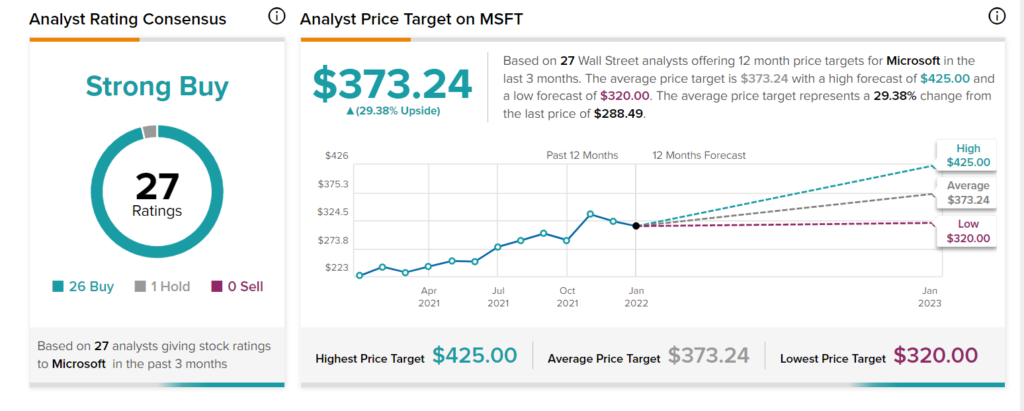

Shares have rallied 24.9% over the past year, while Wall Street analysts are still bullish about the stock. The Strong Buy consensus rating boasts 26 Buys versus 1 Hold. Looking ahead, the average Microsoft price target stands at $373.24, putting the upside potential at 29.38% from current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AstraZeneca Announces Orphan Drug Designation for Eplontersen in the U.S.

Tesla’s Debt Rating Upgraded by Moody’s, Outlook Positive

Logitech: Q3 Earnings Outperform; 2022 Guidance Raised