Microsoft is planning to build new cloud data centers in Greece in a move, which will add the country to the tech giant’s regional cloud hubs around the world.

As part of the investment, Microsoft (MSFT) will train about 100,000 people in Greece in digital technologies by 2025 and help accelerate the digitization of the public sector and businesses with access to local cloud services. Although the size of the investment wasn’t disclosed, AP reported that it amounts to up to $1 billion.

“By a substantial margin, this is the largest investment Microsoft has made in Greece in the 28 years we have been operating here. In part, this reflects confidence that our world-leading datacenter technology can help enable innovation and growth across Greece’s economy,” said Microsoft President Brad Smith. “In addition, this large investment reflects our optimism about Greece’s future, its forward-leaning government, and the country’s ongoing economic recovery.”

Microsoft also announced that Alpha Bank, Eurobank, National Bank of Greece, OTE Group, Piraeus Bank, Public Power Corporation (DEI) have all expressed their intent to use the Microsoft Cloud services when available from the new region in Greece.

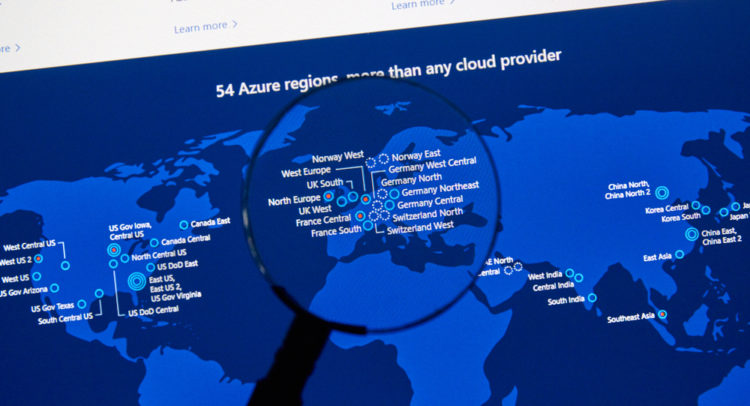

The Greece data center region will join Microsoft’s global footprint of cloud regions, now counting 63 regions, with Microsoft Azure available in over 140 countries. The infrastructure provides companies local access to Microsoft’s full set of cloud services.

Shares in Microsoft have gained about 31% so far this year as the tech giant continues to benefit from increased demand for remote services and shift to cloud solutions during the coronavirus pandemic. (See Microsoft stock analysis on TipRanks)

Wedbush analyst Daniel Ives last week reiterated a Buy rating on the stock with a Street High price target of $260 (26% upside potential), saying that the stock is his top cloud pick.

“We believe deal flow looks strong heading into FY21 as we estimate that Microsoft is only 35% through penetrating its unparalleled installed base on the cloud transition,” Ives wrote in a note to investors. “To this point, we believe Azure’s cloud momentum is still in its early days of playing out within the company’s massive installed base and the Office 365 transition for both consumer/enterprise is providing growth tailwinds over the next few years.”

“From a valuation basis, even if we take a 10%+ haircut (for a 1-2 quarter deep recessionary environment) to the cloud and enterprise growth drivers, we are still looking at what we value as a $1 trillion valuation cloud franchise,” the analyst summed up.

The rest of the Street shares Ives’ bullish outlook on the stock. The Strong Buy consensus scores 24 Buy ratings versus 3 Hold ratings. The average price target of $230.92 implies another 12% upside potential over the coming year.

Related News:

Alibaba To Take Dufry Stake, As Part Of Online Travel Venture

Alibaba-Backed XPeng Posts Record EV Deliveries; UBS Sees 37% Upside

Amazon Teams Up With Universal, Warner To Remaster Thousands of Songs