Tech giant Microsoft (NASDAQ:MSFT) made a good bet when it backed OpenAI if the recent valuations emerging around it are any indication. OpenAI recently concluded a deal that, if everything goes as planned, sees the company valued at at least $80 billion. That hiked its valuation three-fold since the last deal, which took place just a few months ago.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

It also makes OpenAI one of the most valuable tech start-ups on the planet right now, coming in behind only ByteDance and SpaceX. Generative AI has been on an upward tear for some time now, though it’s beginning to generate a full-on backlash as knowledge workers begin to fear for their jobs.

The Fallout Approaches

Indeed, knowledge workers are fearing for their jobs in numbers not seen since the Great Recession. We’ve already seen rising layoffs in media as investor backing dries up in earnest; just look at places like Vice and the L.A. Times. Meanwhile, OpenAI’s latest tool, Sora—a text-to-video generation system—is increasingly regarded as a “potentially dangerous step in the booming AI economy….”

While most of that danger focuses on disinformation, there’s also the matter of large entertainment industry sectors being wiped out by people who can make their own movies at home by entering a prompt and watching the show. Given that both Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) are working on their own versions, it’s clear that this potential danger will increase.

What Is the Target Price for Microsoft Stock?

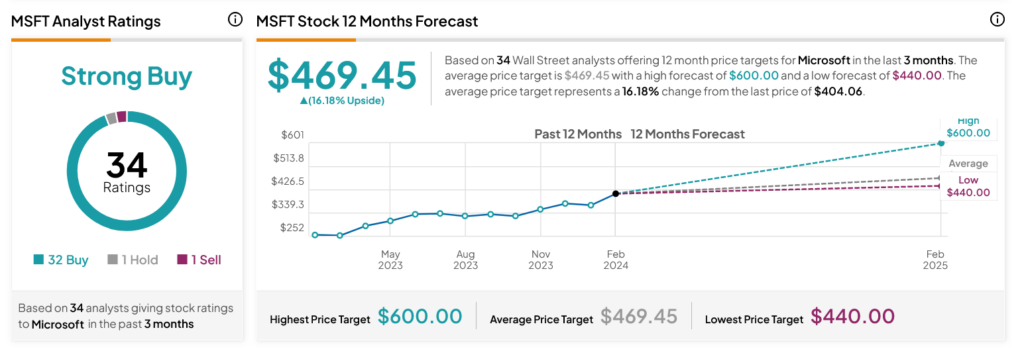

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 61.23% rally in its share price over the past year, the average MSFT price target of $469.45 per share implies 16.18% upside potential.