Microsoft (NASDAQ:MSFT) and Activision Blizzard (NASDAQ:ATVI) have agreed to postpone the deadline for closing the $69 billion deal to October 18. The decision comes after the merger failed to close on the original deadline, i.e., on July 18. Importantly, the companies aim to move past all the regulatory hurdles, including the approval of the UK’s Competition and Markets Authority (CMA), in these three months.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The extension, however, comes at a cost. If the deal is abandoned by August 29, Microsoft will be liable to pay a termination fee of $3.5 billion, up from the previously agreed $3 billion. Moreover, if the transaction is terminated after September 15, the fee will be $4.5 billion.

Current Regulatory Scenario

The U.K.’s antitrust regulator remains the main obstacle for the companies, as U.S. District Judge Jacqueline Scott Corley’s ruling favored Microsoft, permitting the deal to proceed in the U.S.

In addition, a U.S. federal judge denied the Federal Trade Commission’s attempt to block the merger. Moreover, the companies have obtained support from regulators in key international markets, including Europe, China, and Japan.

However, the CMA’s decision on the acquisition is expected on August 29. The regulator has agreed to consider restructuring the merger, requiring a new investigation into the changes. Earlier, the CMA blocked the deal due to concerns over its impact on the nascent cloud gaming market and the streaming of video games over the internet.

Is Microsoft a Buy, Sell, or Hold?

MSFT has made some encouraging announcements of late, such as a partnership with Meta Platforms (META) to offer the artificial intelligence (AI) model Llama for commercial use. Also, Microsoft plans to charge $30 per month for its AI-powered version of the Microsoft 365 suite, called Microsoft 365 Copilot. These developments have the potential to significantly boost the company’s revenue and profit in the future.

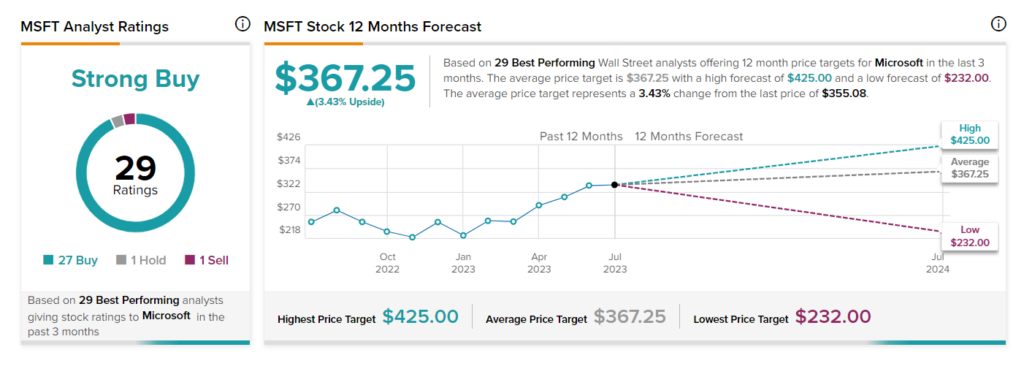

The consensus rating of the 29 top Wall Street analysts who recently rated MSFT stock is a Strong Buy. This is based on 27 Buy, one Hold, and one Sell ratings assigned in the past three months. Further, the average MSFT stock price target of $367.25 implies 3.43% upside potential from current levels.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations.