Investors got a scare this week after softer-than-expected earnings from Meta cast some doubt on the staying power of the AI boom. But Thursday’s results from Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) may have put those fears to rest. Both companies reported solid results, with the strength resting on their AI initiatives.

Generative AI technology has been generating headlines throughout the tech world since the introduction of ChatGPT in November of 2022. It’s found uses in a wide array of applications, including online advertising, internet search, digital assistants, cloud computing – it seems every day, there’s another use for AI.

The strength of AI, as a revenue and profit driver, and the demonstrated strength of Microsoft and Alphabet, both ‘Magnificent 7’ stocks, has caught the attention of some of Wall Street’s top analysts, pros who’ve built their reputations on the depth of their insights and the quality of their recommendations. And now, they’re recommending investors buy into these two mega-caps in the wake of the earnings reports. Let’s take a closer look at them, and at the analysts’ comments.

Microsoft

We’ll start with Microsoft, the largest publicly traded stock on Wall Street. Beyond its dominance in software and PCs, Microsoft has become a leading driver in the adoption of AI. The tech giant recognized the potential of AI early on and became an investor in OpenAI, the firm that developed and released ChatGPT. Starting in 2019, Microsoft has invested a total of $10 billion in the AI developer, an investment that has brought direct benefits to the software company.

Those benefits can be seen in some of Microsoft’s own recent releases. Microsoft has worked to integrate AI tech into its Bing search engine, in an effort to make it more competitive with Google. In addition, the latest releases of Windows and Office have included Copilot, Microsoft’s new AI-powered online assistant. These are impressive AI moves, but they are not the end. Microsoft has also been adding AI features to Azure, its cloud computing platform. Azure provides more than 200 cloud-based applications to its subscribers, and these software tools will soon add value with AI upgrades.

The value of AI to Microsoft can be seen in the company’s recent earnings report, for fiscal 3Q24. The company’s $61.9 billion in revenue was just over $1 billion more than the forecast – and was up 17% year-over-year. The gains were driven by AI-related segments; Azure and other cloud services were up 31%, while the company’s Intelligent Cloud segment as a whole was up 21%. At the bottom line, Microsoft reported an EPS of $2.94, up 20% year-over-year and some 11 cents per share better than the estimates.

For top analyst Daniel Ives, covering MSFT from Wedbush, AI success is the key to Microsoft’s story.

“As Microsoft looks to unlock more use cases with foundational cloud AI, this quarter proved that the right moves are being made to further expand Copilot conversions for the rest of this year. Another major focus of the Street remains Azure revenue growth which saw growth of 31% above the Street’s 29% estimate as more enterprises sign up for the AI functionality increasing deal flow while further expanding market share. We continue to believe MSFT is well positioned to continue generating profitable growth with Copilot further accelerating the growth story,” Ives opined.

Ives goes on to rate Microsoft stock as Outperform (i.e. Buy), and he backs that with a $500 one-year price target, pointing toward a 23% upside potential. (To watch Ives’ track record, click here)

Overall, Microsoft has 32 Buy ratings from the analysts, along with 1 Hold and 1 Sell, for a Strong Buy consensus rating. The shares are selling for $406.32, and their $477.41 average target price suggests a one-year potential upside of 17.50%. (See Microsoft stock forecast)

Alphabet

Next up is Alphabet, best-known as the parent company of Google and YouTube. These two subsidiaries hold the lion’s share of the online search market, Google as a search engine, YouTube in online video search, and both in online advertising. Together, their operations have pushed Alphabet into the very top ranks of Wall Street giants; the company boasts a market cap well over $2.1 trillion and is the fourth-largest publicly traded firm.

Over the past year, Alphabet has been making strong moves into the AI world. The company’s subsidiaries have multiple routes toward the use and monetization of AI. These initiatives include Waymo, an autonomous driving venture, as well as Large Language Modules on Google Cloud. The latter comprise an online translation service based on a combination of AI and natural language processing, capable of providing clear text translations and writing assistance across multiple languages. Alphabet is also using AI to improve Google’s search engine ad functionality and its search results.

While Alphabet’s success has been driven by its dominance of online search, the company makes its money from online advertising. In the 1Q24 earnings report, Alphabet showed a top line of $80.54 billion, up 15% year-over-year and above the $78.7 billion forecast. The company’s Google Advertising segment generated $61.66 billion of that total, or 76.5% of the total top line. At the bottom line, Alphabet generated earnings of $1.64 per share, 4 cents better than had been expected.

Based on the first-quarter success, Alphabet also declared its first-ever dividend, at 20 cents per common share. Going forward, this payment annualizes to 80 cents per share and gives a modest forward yield of 0.51%. This first-ever dividend is complemented by a $70 billion buyback authorization.

Watching GOOGL from Truist, Youssef Squali, a 5-star analyst rated in the top 3% of the Street’s stock pros, sees plenty of reasons for investors to buy in on this tech stock.

“We’re incrementally bullish on GOOGL following stronger than expected 1Q24 results, which reflect acceleration across Search, YT, and Cloud. This broad-based outperformance is driven by healthy demand, augmented by AI improvements across products as mgmt reigns in costs, focuses investments on the highest growth priorities (AI, tech infrastructure, YT) while improving margins and FCFs. We believe GOOGL remains at the forefront of the AI race, which should help drive growth higher for longer, and support a compelling case for the stock,” Squali wrote.

To this end. Squali puts a Buy rating on GOOGL shares, and his $190 price target shows a potential gain of 10.5% in the next 12 months. (To watch Squali’s track record, click here)

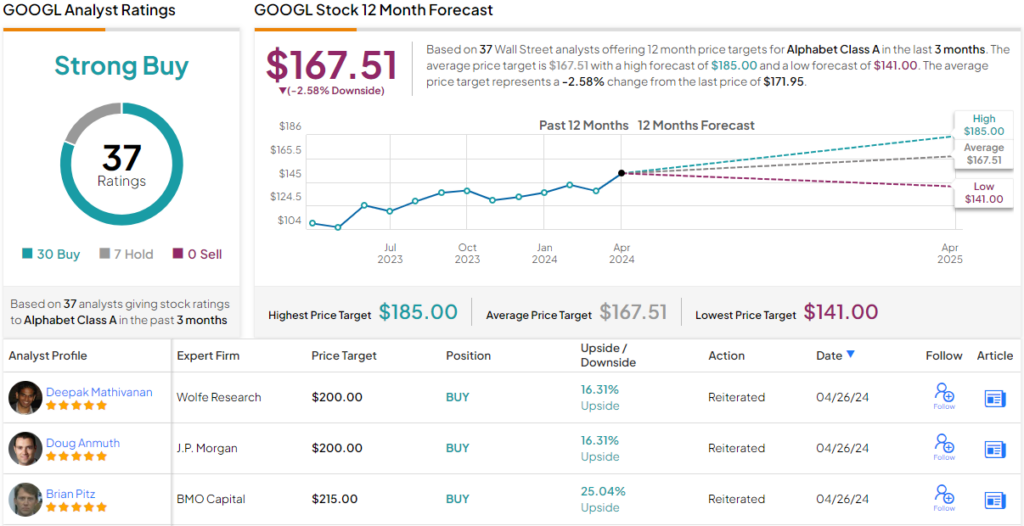

All in all, there are 37 recent analyst reviews of Alphabet’s stock, with a breakdown of 30 Buys to 7 Holds for a Strong Buy consensus rating. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.