Micron Technology, Inc. (MU) delivered stellar first-quarter results aided by solid demand for all of its product offerings.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Despite the ongoing global chip shortage, MU, which is a global leader in providing innovative computer memory and data storage solutions, managed to outperform estimates and also provided guidance that beat expectations.

Following the results, shares soared 6.8% during the extended trading session on December 20.

Stellar Results

Micron’s adjusted earnings jumped a whopping 177% to $2.16 per share, and came in 5 cents higher than analysts’ estimates of $2.11 per share.

Moreover, revenue of $7.69 billion increased 33.3% compared to the prior-year quarter, and marginally came in line with the Street estimates of $7.67 billion.

In its upcoming dividends, Micron’s Board declared a quarterly cash common dividend of $0.10 per share payable on January 18, 2022, to shareholders on record as of January 3, 2022.

Management Comments

President and CEO of Micron Technology, Sanjay Mehrotra, said, “We are now shipping our industry-leading DRAM and NAND technologies across major end markets, and we delivered new solutions to data center, client, mobile, graphics, and automotive customers. As powerful secular trends including 5G, AI, and EV adoption fuel demand growth, our technology leadership and world-class execution position us to create significant shareholder value in fiscal 2022 and beyond.”

Upbeat Guidance

Based on the underlying business momentum, Micron forecasts second-quarter revenue to fall between $7.3 billion and $7.7 billion, exceeding consensus estimates of $7.27 billion.

Additionally, adjusted earnings are projected to be in the range of $1.85 per share to $2.05 per share, while the consensus is pegged at $1.86 per share.

Wall Street Take

Impressed with Micron’s solid quarterly performance, Robert W. Baird analyst Tristan Gerra lifted the price target on the stock to $90 (9.7% upside potential) from &70 while maintaining a Hold rating.

Gerra noted that Micron’s earnings and guidance reflect that the memory segment is currently in a mid-cycle correction, and warns of inflation and the pandemic as potential headwinds for the near term.

However, the analyst is positive about the healthy end-demand. Gerra said, “With PC inventory adjustments mostly behind, while Micron’s inventory days remain at significantly lower levels than in F2019/F2020, representing a forward-measure of healthy supply/demand. This, along with improving mix, resulted in a gross margin outlook remaining close from its recent peak, highlighting the improving company and industry fundamentals.”

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 17 Buys, 5 Holds, and 1 Sell. The average Micron price target of $99.32 implies 21.08% upside potential to current levels. Shares have gained 14.8% over the past year.

Bloggers

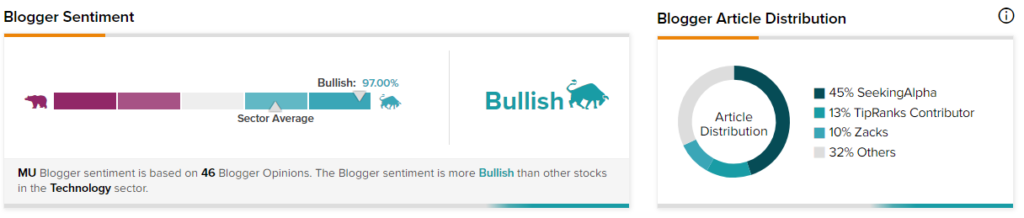

TipRanks data shows that financial blogger opinions are 97% Bullish on MU, compared to a sector average of 70%.

Related News:

Darden Restaurants Beat Q2 Estimates; Shares Down 5%

GM Delivers First EV Pickups to Customers & EV600s to FedEx

Why Did Affirm Stock Plunge 10.6% Yesterday?