Micron Technology reported stronger-than-expected 1Q results, driven by robust demand for its memory chips. Shares of the memory chip maker gained 1.3% in Thursday’s extended market trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Micron’s (MU) 1Q sales increased 12.2% to $5.77 billion year-on-year and surpassed analysts’ expectations of $5.73 billion. Its adjusted EPS of $0.78 grew a stellar 62.5% year-over-year and beat the Street’s estimates of $0.71.

Buoyed by better-than-expected first-quarter performance, Micron issued a strong outlook for 2Q. The company expects revenues of $5.8 billion (+/- $200 million), which is above the consensus estimate of $5.52 billion.

Micron forecasted 2Q adjusted EPS of $0.75 (+/- $0.07) compared to the $0.63 per share estimated by analysts. (See MU stock analysis on TipRanks)

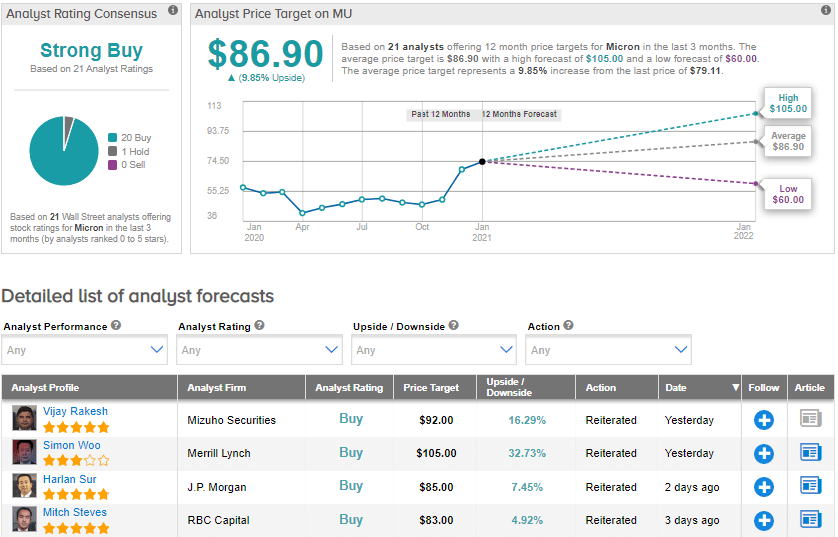

Following the earnings release, Mizuho Securities analyst Vijay Rakesh raised the stock’s price target to $92 (16.3% upside potential) from $85 and reiterated a Buy rating.

In a note to investors, Rakesh wrote, “We see MU well-positioned for a stronger 2021 with a DRAM (dynamic random access memory) (70% of revenues) inflection as low inventory, controlled capex, and strong demand trends in mobile and improving 2021 data center outlook drive DRAM ASP (average selling price) upside combined with 2H21 NAND stabilization.”

Overall, consensus among analysts is a Strong Buy as 20 analysts assign a Buy rating, while 1 analyst says Hold. The average price target of $86.90 implies upside potential of around 9.9% over the next 12 months. Shares have advanced 35.8% over the past year.

Related News:

Greenbrier Posts Wider-Than-Expected 1Q Loss; Top Analyst Says Buy

MSC Industrial Tops 1Q Street Estimates; Raymond James Sticks To Hold

Bed Bath & Beyond Sinks 11% As Quarterly Sales Miss Street Bets