Shares of Micron Technology (MU) rose 13% in after hours trading on news that the data storage company’s financial results beat Wall Street forecasts.

For its Fiscal fourth quarter, Micron reported earnings per share (EPS) of $1.18, which topped the $1.11 that was expected among analysts who track the company’s progress. Revenues for the quarter totaled $7.75 billion, which also beat consensus estimates that called for $7.65 billion.

In a news release announcing the results, Micron said that its Fiscal Q4 revenue rose 93% from a year earlier, driven by sales of its data center DRAM products. The company said it continues to see strong demand for its products related to artificial intelligence (AI).

Micron Issues Strong Forward Guidance

Looking ahead, Micron forecast Fiscal first quarter 2025 earnings of $1.74, which was well ahead of the $1.52 that Wall Street had penciled in for the company. Micron added that it expects Fiscal Q1 2025 revenue of $8.50 billion to $8.90 billion, which was also better than the $8.32 billion consensus view of analysts.

Management said that strong demand for its high bandwidth memory (HBM) chips used in AI applications and models should drive growth in the current quarter. The company added that it expects a gross margin of 39.5%, plus or minus 1%, in Fiscal Q1 2025. Analysts had expected a gross margin of 37.7%.

Is MU Stock a Buy?

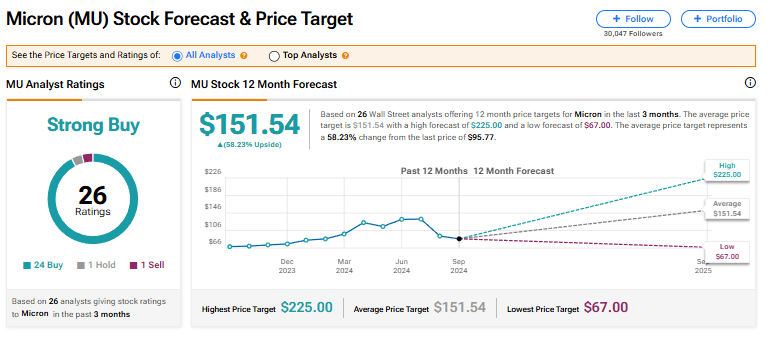

Micron stock has a Strong Buy rating among 26 Wall Street analysts. The rating is based on 24 Buy, one Hold, and one Sell recommendations made in the last three months. The average price target on MU stock of $151.54 implies 58.23% upside from current levels.