Shares of Micron fell 4.8% on Thursday after its CFO warned that the chipmaker could miss 1Q revenue guidance.

Speaking at Keybanc’s virtual conference, Micron’s (MU) CFO David Zinsner stated that the demand outlook for memory chips is worsening, Bloomberg reported. As a result, Zinsner cautioned that 1Q (September to November) sales could come below the forecast of $5.4 billion-$5.6 billion.

Meanwhile, Zinsner kept the company’s revenues outlook for the current quarter (June to August) unchanged. Micron expects to generate sales of between $5.75 billion and $6.25 billion during the fourth quarter.

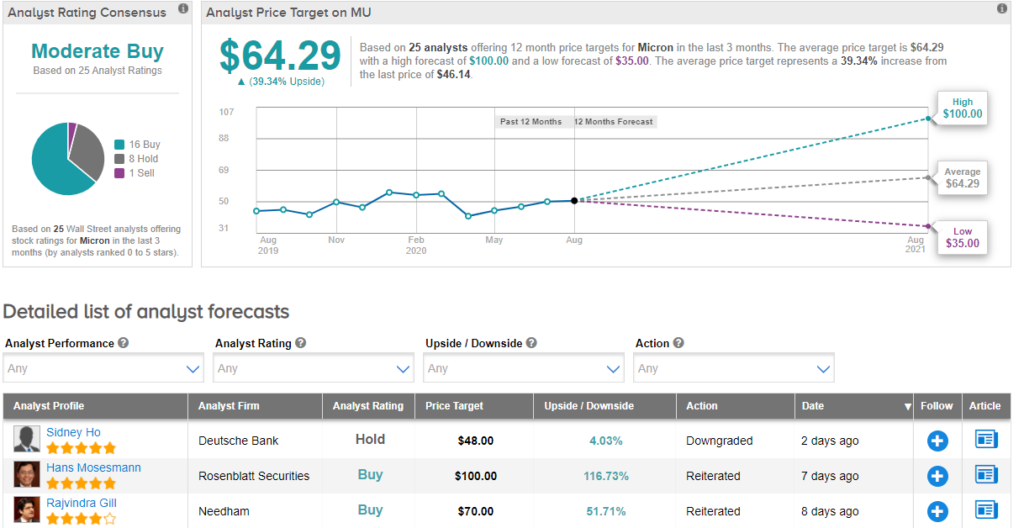

On Aug. 12, Deutsche Bank analyst Sidney Ho downgraded the stock to Hold from Buy citing lower memory chip pricing expectations due to supply-demand mismatch. In a note to clients, Ho wrote “Inventory build-up at cloud data center customers looks worse than he had anticipated, while demand from other end markets is weakening.”

Overall, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 16 Buys, 8 Holds, and 1 Sell. The average price target of $64.29 implies upside potential of about 39%. (See MU stock analysis on TipRanks).

Related News:

Deutsche Bank Cuts Micron To Hold Amid Lower Memory Pricing Bet

Despite Lowering Estimates, Micron Is Still a Sound Investment, Says 5-Star Analyst

Upcoming Tailwinds Will Push Micron Stock Forward, Says 5-Star Analyst