GlaxoSmithKline (GSK) and Vir Biotechnology, Inc. (VIR) have been granted conditional marketing authorization for Xevudy (sotrovimab) from the U.K. Medicines and Healthcare products Regulatory Agency (MHRA).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Xevudy, the investigational SARS-CoV-2 neutralizing monoclonal antibody, has been designed to treat symptomatic adults and adolescents (aged 12 years and over and weighing at least 40 kg) with acute COVID-19 infection who do not require additional oxygen and are prone to progressing towards severe COVID infection.

Xevudy is recommended to be administered within 5 days after showing symptoms of COVID-19. In the near term, sotrovimab will be accessible to U.K. patients following a supply agreement inked with the U.K. government. Notably, the conditional marketing authorization covers England, Scotland, and Wales.

Trial Update

MHRA’s authorization was based on the final analysis from the COMET-ICE trial. The data demonstrated a 79% reduction in hospitalization for more than 24 hours or death compared to the placebo. Notably, in the clinical trials, sotrovimab reflected a significant reduction in the risk of hospitalization or death among high-risk adult outpatients with mild to moderate COVID-19 symptoms. Additionally, the antibody has shown a well-tolerated profile in clinical studies to date. (See GlaxoSmithKline stock charts on TipRanks)

Official Comments

SVP, Europe, George Katzourakis, said, “The conditional marketing authorization in Great Britain, coupled with the supply agreement, is a testament to the critical need to make sotrovimab available in the UK as the pandemic continues to progress. We believe it is important to ensure that we have treatments ready and available, especially early treatment options, for a broad group of patients at increased risk of progressing to severe COVID-19.”

Sotrovimab has been continually evaluated by the companies as the COVID-19 landscape continues to evolve at different rates globally with new variants.

Wall Street’s Take

On November 29, J.P. Morgan analyst James Gordon reiterated a Hold rating and a price target of £1,580 (3% upside potential) on GlaxoSmithKline.

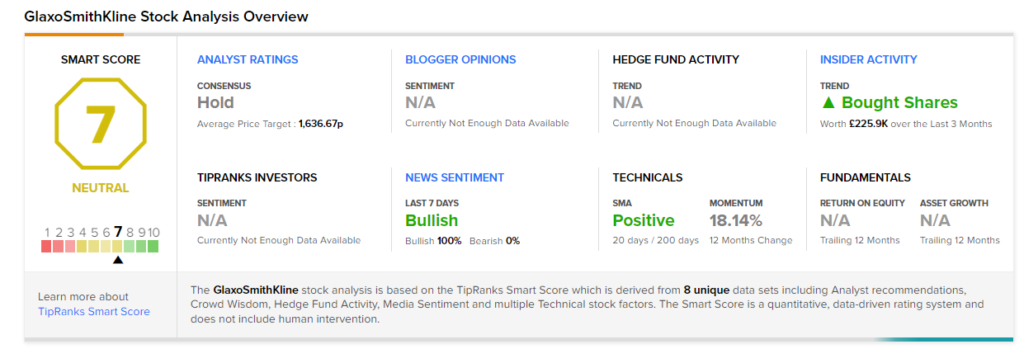

Consensus among analysts is a Hold based on 4 Buys, 8 Holds, and 1 Sell. The average GlaxoSmithKline price target of £1,636.67 implies 7.03% upside potential from current levels. The stock has gained 11.6% over the past year.

Smart Score

According to TipRanks’ Smart Score system, GlaxoSmithKline gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages. (See Top Smart Score Stocks on TipRanks)

Related News:

Okta Posts Lower-than-Feared Q3 Loss, Revenue Beats Estimates

Splunk Books Lower-than-Feared Q3 Loss; Shares Rise After-Hours

Amgen Reveals Topline Results from Otezla Phase 3 DISCREET Study