In Canada, Metro (TSE:MRU) is a big name when it comes to groceries and pharmacy supplies. And it looks to make itself a bigger name still thanks to a newly-opened automated distribution center in Toronto. Investors were skeptical, though, and sent shares down fractionally in Tuesday morning’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The new distribution center set Metro back about $1 billion, reports noted, and represents the culmination of a project that has been running since 2017. With the new distribution center in place, Metro stands to reap several benefits, including improvements in efficiency, accuracy in order fulfillment, and an improved customer experience. All of these together should go quite a way toward driving growth for the supermarket chain.

This is not the only such project Metro had in the works, though. New distribution centers went up in Quebec—one for fresh produce and one for fresh and frozen goods—and two others in Toronto, which have been opening over the last two years.

Building on a Trend

All these new distribution centers seem to be in aid of a trend that has been growing for a while now. Metro’s sales have been on the rise as Canadian shoppers look toward discount brands to save money in the face of still-high inflation. So, being able to better stock those stores with the brands customers want should help ensure they make the most out of that trend.

Indeed, Metro has also been spotted building out its Metro Plus line, and that is a process that has been ongoing since 2004. Back then, Metro called Metro Plus its “…answer to Sam’s Club,” an answer that has become all the more important these days.

Is Metro Stock a Good Buy?

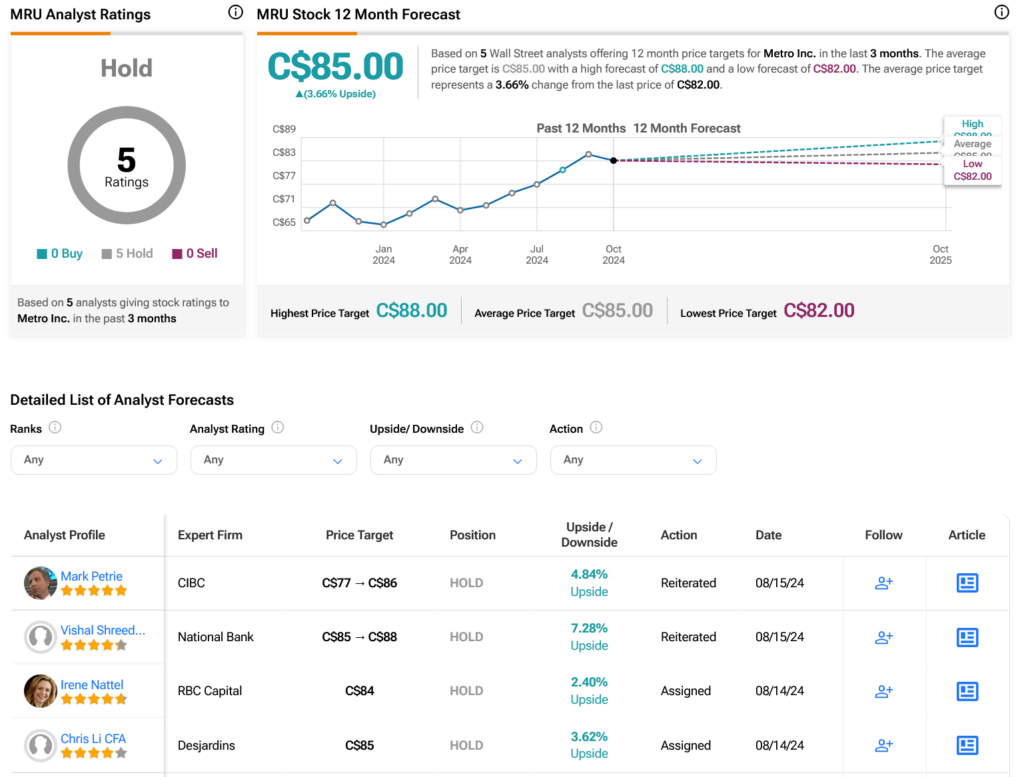

Turning to Wall Street, analysts have a Hold consensus rating on TSE:MRU stock based on five Holds assigned in the past three months, as indicated by the graphic below. After an 18.78% rally in its share price over the past year, the average TSE:MRU price target of C$85 per share implies 3.66% upside potential.