Shares of Metro Inc. (MRU) fell 3% in early trading Wednesday, after the food and pharmacy retailer posted lower sales and profit in the third quarter of 2021 than a year earlier. Last year’s sales were fueled by shoppers stocking up for the pandemic.

Sales came in at C$5.72 billion for the quarter ended July 3, a decrease of 2% from C$5.84 billion in the prior-year quarter. In addition, food same-store sales decreased by 3.6%, while pharmacy same-store sales increased by 7.6%.

Meanwhile, Q3 2021 profit was C$252.4 million (C$1.03 per diluted share), compared to a profit of C$263.5 million (C$1.04 per share) in Q3 2020. On an adjusted basis, Metro earned C$1.06 per diluted share for the quarter, compared to adjusted earnings of C$1.08 per diluted share a year ago.

COVID-19 spending totaled C$38 million in the third quarter, down from C$107 million in the same quarter last year. (See Metro Inc. stock charts on TipRanks)

Metro president and CEO Eric La Flèche said, “We are pleased with the solid results of our third quarter considering we cycled exceptionally strong sales and earnings last year at the height of the pandemic. Our sales and earnings growth over 2019 levels is strong.

“Despite the challenging operating environment caused by the pandemic, our teams successfully completed three key strategic initiatives during the quarter: the transition to our new automated Fresh distribution center in Toronto; the integration of our pharmacy distribution operations into the Jean Coutu distribution center in Varennes; and the opening of our dedicated store for online grocery in Montréal. These achievements position us well to meet our growth objectives going forward”.

The company expects its short-term food sales to continue to decline year-over-year, but to remain higher than pre-pandemic levels.

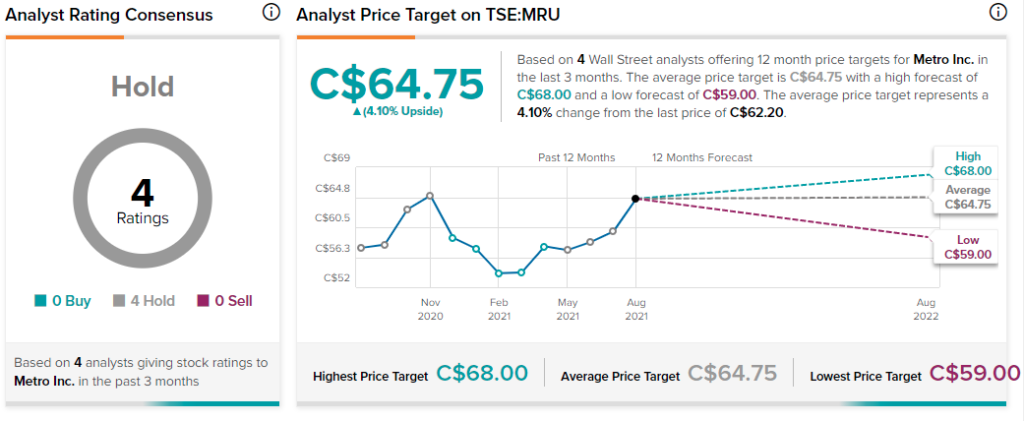

Three days ago, Desjardins analyst Chris Li maintained a Hold rating on the stock with a price target of C$59.00. This implies 5.2% downside potential.

Li said, “We like MRU’s strong regional position, consistent execution and shareholder-friendly capital allocation strategy. But we see limited upside given its premium valuation and lack of near-term catalysts”.

The rest of the Street has given a Hold rating on MRU based on four Holds. The average Metro price target of C$64.75 implies 4.1% upside potential to current levels.

Related News:

Maple Leaf Foods’ Q2 Profit Falls 66%; Shares Pop 7%

Restaurant Brands Posts Better-than-Expected Q2 Results

Loblaw’s Profit Rises 122% in Q2