MetLife, Inc. has announced that it will sell its Metropolitan Property and Casualty Insurance unit to a subsidiary of the Zurich Insurance Group, in an all-cash deal worth $3.94 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

MetLife (MET) is one of the world’s leading financial services providers, which offers a range of investment products to both individual and institutional clients.

As part of the deal, the companies have also entered into a 10-year strategic partnership. According to the terms, insurance products of Zurich subsidiary, Farmers Group, will be made accessible on MetLife’s existing platform, which currently reaches 3,800 employers and 37 million employees. Farmers will also gain access to MetLife’s network of 7,700 independent agents.

MetLife CEO, Michael Khalaf, described the deal as “another bold step in the execution of our Next Horizon strategy”. He said that it would allow MetLife to simplify operations and differentiate their product offerings while focusing on their core strengths.

The deal is expected to be finalized in the second quarter of 2021. Following the closure, MetLife plans to report its property & casualty operations as a divested business in the first quarter of 2021. (See MET stock analysis on TipRanks)

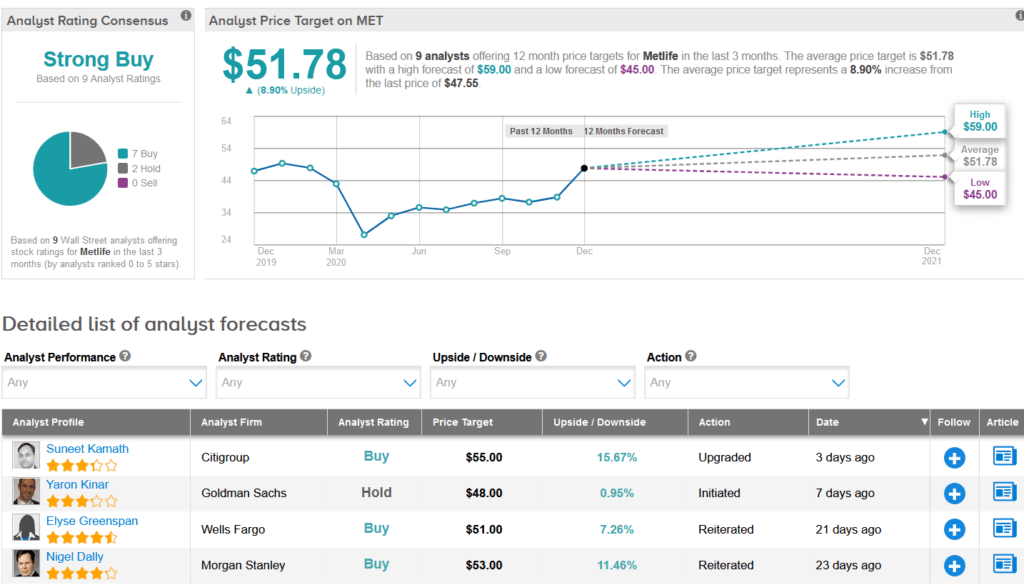

Citigroup analyst Suneet Kamath this week upgraded MET’s rating to Buy from Hold and raised the price target to $55 from $39. This would translate into upside potential of around 16%. Kamath recommends reducing exposure to personal lines and brokers while adding exposure to commercial lines and reinsurance pricing cycle.

Consensus among the rest of the analyst community is a Strong Buy backed by 7 Buy ratings versus 2 Hold ratings. The average price target is $51.78, implies upside potential of around 9% over the next 12 months.

Related News:

Oracle’s 2Q Profit Beats The Street Driven By Strong Cloud Demand

Pfizer-BioNTech’s Covid-19 Vaccine Wins FDA Panel Vote; Shares Rise

Ciena Lags 4Q Profit Estimates; Needham Stays Bullish