Meta Platforms’ (META) AI chatbot just got a news upgrade thanks to a deal with Reuters (TRI) that will give users real-time news updates, according to Axios. This partnership will allow the bot to handle questions on current events across platforms like Facebook, Instagram, and WhatsApp and is one of several recent news deals by major tech players who want to strengthen their AI responses with trusted media sources.

The financial terms of the partnership were not disclosed, but Reuters confirmed it is licensing its content to Meta and stated that it is part of a confidential, multi-year agreement. Interestingly, this marks Meta’s first news content deal in years and comes at a time when Meta has been dialing back its news presence after facing pushback from publishers and regulators over misinformation and revenue-sharing disputes.

This deal also means that Reuters content can now be used to train Meta’s AI model and inform chatbot responses. This collaboration builds on Reuters’ existing fact-checking partnership with Meta, which began back in 2020.

Meta Continues to Improve AI

Meta has recently been rolling out various features for its AI models. In fact, earlier this month, it rolled out a tool that is capable of checking the work of other AI for accuracy, which analysts say is a major step towards eventually building autonomous AI applications.

In addition to that, Meta released AI tools aimed at generating videos for advertisers on its platform. With improvements like this, it is easy to see why the market has rewarded the stock with a 22% rally during the past three months.

Is META Stock a Buy?

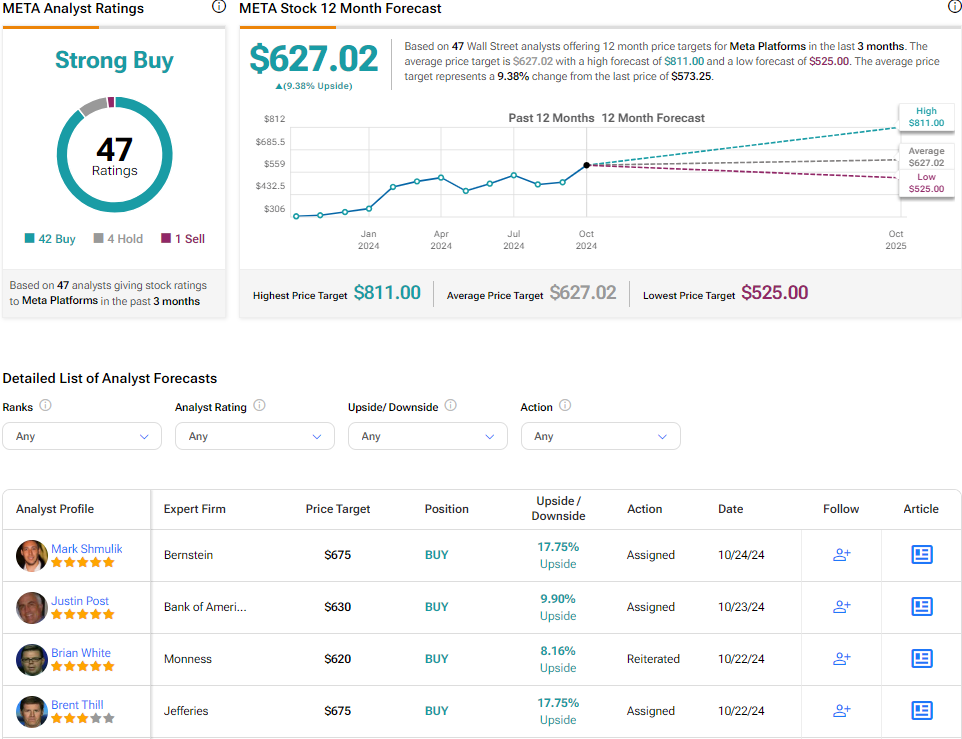

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 42 Buys, four Holds, and one sell assigned in the past three months, as indicated by the graphic below. After a 98% rally in its share price over the past year, the average META price target of $627.02 per share implies 9.4% upside potential.