Meta Platforms- (NASDAQ:META) owned Facebook Marketplace, which allows users to buy or sell new and used items, is at fault for allowing recalled baby products to be sold on its platform. According to a Wall Street Journal report, bipartisan lawmakers, in a letter to its CEO Mark Zuckerberg, pointed out that the company is not taking enough measures to stop users from selling recalled deadly baby items on its marketplace, thus risking public safety.

Report Highlights

The article emphasized that the lawmakers specifically pointed out two recalled baby products—Fisher-Price Rock ‘n Play Sleepers and the Boppy Company’s newborn loungers—that are sold on Facebook Marketplace. These products have been associated with infant deaths.

Meta launched Facebook Marketplace in 2016, and according to its website, it does not promote the buying or selling of recalled products. Besides for Meta, lawmakers have written to 16 other online marketplaces to take preventive actions against the listing of recalled products.

Meta’s Risk Factors

It’s worth highlighting that Meta is heavily exposed to legal and regulatory risks due to the nature of its business, including social networks, digital advertising, and an online marketplace. While the company is currently not facing any legal action for listing recalled products, it has been subject to various litigation and government inquiries and investigations in the past, which resulted in fines and penalties, impacting its financials and share price. With this backdrop, let’s look at the risk profile of Meta Platforms.

The image below shows the risk distribution of Meta Platforms. While the company faces several risks, what stands out is that Meta’s legal and regulatory risks represent about 21.3% of its total risks. Moreover, this percentage is higher than the sector average of 20.3%. Also, its tech and innovation risk is higher than the sector average.

Investors can leverage TipRanks’ risk factors tool to learn more about the risks of a company they are considering investing in. Further, keeping a tab on risks reduces future disappointments.

Coming back to Meta, let’s check what analysts recommend about its stock.

Is It Too Late to Buy Meta Stock?

Meta Platforms stock has gained nearly 139% year-to-date, raising concerns about whether it is too late to buy its shares. However, Wall Street analysts maintain a bullish stance on the stock as the company is driving user engagement and is poised to benefit from the reacceleration in ad revenues, investments in AI (artificial intelligence), and deep cost-cutting measures.

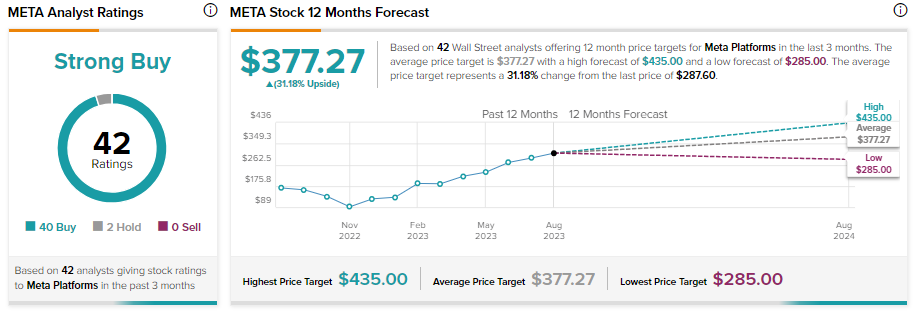

40 out of 42 analysts covering the stock have given it a Buy recommendation. While Meta stock has a Strong Buy consensus rating, analysts’ average 12-month price target of $377.27 implies 31.18% upside potential from current levels.

Questions or Comments about the article? Write to editor@tipranks.com