Meta Platforms Inc. (FB) has yet again threatened to discontinue offering its significant products and services in the European Union amid the ongoing data privacy issues.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the social networking giant are still bleeding from their disappointing results released last week and closed down more than 5% at $224.91 on February 7.

Meta Warns EU

In its annual 10K report filed last Thursday, Meta Platforms warned the EU that it would be forced to pull back its services and products to the nation if the data privacy issues are not resolved at the earliest.

The EU and the U.S. have been at loggerheads regarding the privacy issues connected with the transfer of consumers data to the U.S. The EU is unsure about the security of its citizens once data is transferred to the U.S.

In July 2020, the Court of Justice of the European Union (CJEU) invalidated the Privacy Shield, a framework upon which the data transfer between the nations took place. Moreover, in August 2020, the Irish Data Protection Commission (IDPC) also sent out a preliminary draft decision asking for suspending the data transfers as they did not comply with the General Data Protection Regulation (GDPR).

The Standard Contractual Clauses (SCCs) on which Meta relies for the transfer of data, have been subject to scrutiny since 2020, and Facebook has become weary of the increasing tension between both nations regarding the sharing of customer data.

Meta wrote the following in its annual report, “If a new transatlantic data transfer framework is not adopted and we are unable to continue to rely on SCCs or other alternative means of data transfers from Europe to the United States, we will likely be unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe.”

Official Comments

In an email statement to Bloomberg, a Meta spokesman said, “We have absolutely no desire and no plans to withdraw from Europe, but the simple reality is that Meta, and many other businesses, organizations, and services, rely on data transfers between the EU and the US in order to operate global services.”

Meanwhile, a European Commission spokesperson emailed saying, “data transfer negotiations with Washington have intensified, but they take time given also the complexity of the issues discussed and the need to strike a balance between privacy and national security.”

“Only an arrangement that is fully compliant with the requirements set by the EU court can deliver the stability and legal certainty stakeholders expect on both sides of the Atlantic,” concluded the spokesperson.

Wall Streets’ Take

The Wall Street community is cautiously optimistic about the FB stock based on 31 Buys, 10 Holds, and 1 Sell. The average Meta Platforms price target of $330.35 implies 46.9% upside potential to current levels. Shares of one of the FAANG stocks, FB are down 33.6% year-to-date.

News Sentiment

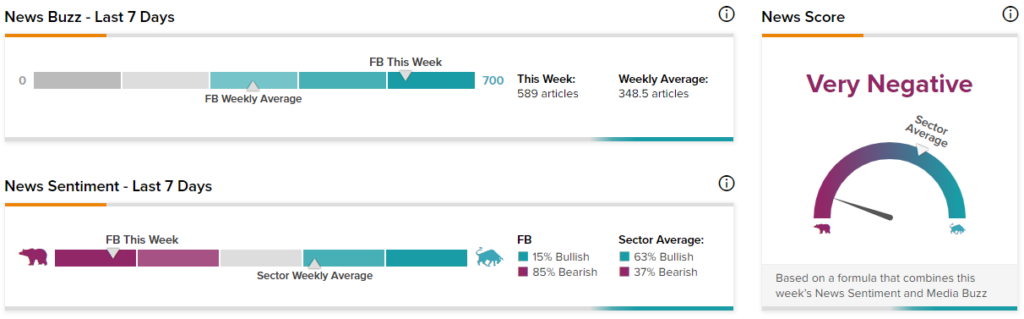

According to TipRanks data, the News Score for Meta Platforms is currently Very Negative based on 589 articles published over the past seven days. 15% of the articles have a Bullish Sentiment compared to a sector average of 63% while 85% of the articles have a Bearish Sentiment compared to a sector average of 37%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Kohl’s Initiates Poison Pill to Stop Hostile Takeover; Shares Jump

Chip Shortage Forces Ford to Suspend Production at 8 Plants – Report

Bank of America Hikes CEO Pay by 31% to $32 Million