Meta Platforms (FB) is considering introducing virtual currencies to its family of social apps, according to a Financial Times report. The Mark Zuckerberg-led company is looking at a different approach from its shuttered blockchain-based crypto project, Diem.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meta is looking at launching various types of virtual currencies that are internally called Zuck Bucks. One type would be “social tokens” that could be used to reward people for their contributions to Facebook groups. Another type could be “creator coins” that fans could use to reward their favorite creators on Instagram. The virtual tokens would also be part of Meta’s metaverse strategy, which also includes an NFT project.

According to the report, the so-called Zuck Bucks will be centrally controlled virtual currencies instead of being built on the blockchain like the ill-fated Diem.

Meta Looking Beyond Advertising for Revenue

The virtual currencies plan is part of Meta’s efforts to unlock additional revenue opportunities outside advertising. Although advertising has long been Meta’s primary source of revenue, the business has come under a variety of challenges, including competition from TikTok and the like. Apple’s (AAPL) privacy changes that make it difficult to track people’s activities across apps have also come as a blow to Facebook’s advertising business.

In seeking alternative revenue opportunities, Facebook is also considering launching a lending service along with the virtual tokens, according to the report. The company is particularly looking at providing small business loans. About 200 million small businesses have Facebook profiles.

Wall Street’s Take

On April 5, UBS analyst Lloyd Walmsley reiterated a Buy rating on Meta Platforms with a price target of $300, which indicates 34.35% upside potential.

The Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 32 Buys versus 13 Holds, and one Sell. The average Meta Platforms price forecast of $325.60 implies 45.8% upside potential to current levels. Shares have declined 34% year-to-date.

Blogger Opinions

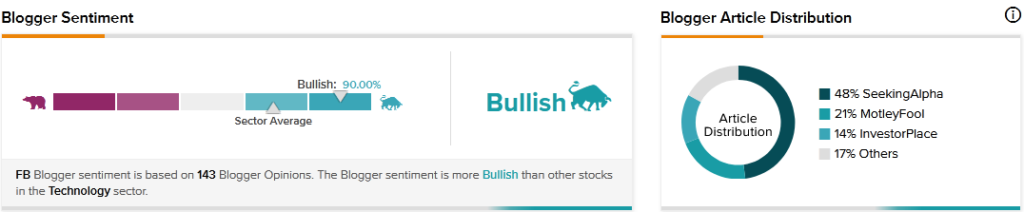

TipRanks data shows that financial blogger opinions are 90% Bullish on FB, compared to a sector average of 69%.

Key Takeaway for Investors

With about 4 billion monthly active users and millions of businesses across its apps, Meta has a massive potential market for the financial services it is planning to launch. However, with the failure of Diem despite all the efforts put into it, there can be no guarantee that Meta will be successful in its latest financial services efforts.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

L3Harris Ensures Revenue Certainty with 10-year Space Contract

Toyota to Develop Cheap Self-Driving Cars

JPMorgan Customers Unlock Frozen Stake in Russian Firms