Expanding its footprint in the Metaverse space, Meta Platforms, Inc. (NASDAQ:META) has acquired a Berlin-based virtual reality (VR) startup, Lofelt GmbH. The tech giant noted that the buyout was concluded a few days back, but its news was officially announced only on Friday. The financial terms of the buyout have not been disclosed by the two Metaverse players.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that META stock slipped 3.1% to close at $160.32 on Friday.

In addition to synergies, this buyout has grabbed the market’s attention as a few days ago the Federal Trade Commission (FTC) refrained Meta Platform’s CEO, Mark Zuckerberg, from buying VR player Within Unlimited Inc. and its Supernatural app. The FTC believes that “Meta is trying to buy its way to the top” instead of “competing on the merits.”

The Rationale behind Lofelt’s Buyout

Meta Platforms, earlier known as Facebook, believes that the acquisition of Lofelt would enhance its technological capabilities, especially related to haptic technology. Lofelt’s most popular product is Lofelt Studio.

Interestingly, experiences of touch can be created in the immersive virtual world for users with the help of haptic technology. Notably, Lofelt primarily uses vibrations or forces in the VR hardware to create touch experiences in the Metaverse space.

In addition to the knowledge about haptic technology, the buyout of Lofelt has added 25 experienced personnel to Meta Platform’s team. One of the officials of Meta Platforms said, “We’re excited that members of the Lofelt team have joined Meta.”

How Big Is Meta Platforms in the Metaverse Space?

Over time, the $430.69-billion tech behemoth has been strengthening its footprint in the Metaverse space. Through its focus and dedicated investments, the company has developed, and is popular for, Horizon Worlds (a Metaverse platform), Meta Avatars Store (a clothing store for the Metaverse space), and Quest 2 VR headsets.

Also, the tech giant recently signed a deal with Qualcomm (NASDAQ:QCOM) (GB:0QZ3) to manufacture chips for its Quest headsets used in the VR world.

In addition to the above organic means of expansion, Meta Platforms has been an active acquirer in the Metaverse space. Among many others, the acquisitions of Oculus VR in March 2014, Lemnis Technologies in September 2020, BigBox VR in June 2021, and ImagineOptix Corp. in December 2021 are worth mentioning.

Is Meta Platforms Stock a Buy or Sell?

If analysts tracked by TipRanks are to be believed, Meta Platforms stock could be an attractive investment option for prospective investors.

Out of 34 analysts tracking META stock on TipRanks, 27 have a Buy rating, five analysts have a Hold rating, and two have a Sell rating. META’s average price forecast is $224.21, which mirrors upside potential of 39.85% from the current level.

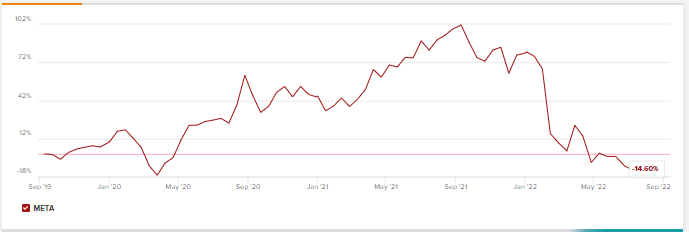

Shares of META are currently trading near the lowest level of their 52-week range of $154.25-$384.33. Investors believing in the long-term prospects of the company, as the Metaverse gains popularity, could enjoy buying this dip. A chart depicting the stock’s price trajectory is provided below.

Read full Disclosure