Meta Platforms (NASDAQ:META) focuses on driving revenues and profitable growth. As part of its broader restructuring plan, the company has turned its attention to investing resources in AI projects with the potential to generate revenues, the Financial Times reported. It has abandoned its ESMFold project, which leveraged AI (Artificial Intelligence) for predicting protein structures but generated no revenues.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The report highlighted that the ESMFold group was dissolved this spring as part of its restructuring initiatives. The company has gotten through the significant layoffs and is focusing on introducing new AI-powered tools, said Meta’s CEO, Mark Zuckerberg, during the Q2 conference call. This indicates that the company’s purely scientific projects or Blue Sky projects (research where the direct economic benefits and real world application are unknown), which do not generate any revenues, will take a backseat with some groundbreaking AI products in the pipeline.

Meta has spent billions of dollars on AI infrastructure that is paying off by improving engagement and monetization across its offerings. Further, it partnered with Microsoft (NASDAQ:MSFT) to release its open-source Llama 2, a large language model for research and commercial use. The company recently introduced AudioCraft, a generative AI tool that can generate high-quality audio and music from text.

Overall, Meta’s strong competitive positioning in the generative AI space and deep cost-cutting measures provide a solid foundation for future growth. Against this backdrop, let’s check what the Street recommends for Meta stock.

Is Meta Platforms a Good Stock to Buy?

Meta delivered stronger-than-expected Q2 results. In addition, the company revealed that its ad revenues are reaccelerating and that its investments in AI are driving efficiency and offering substantial growth opportunities ahead.

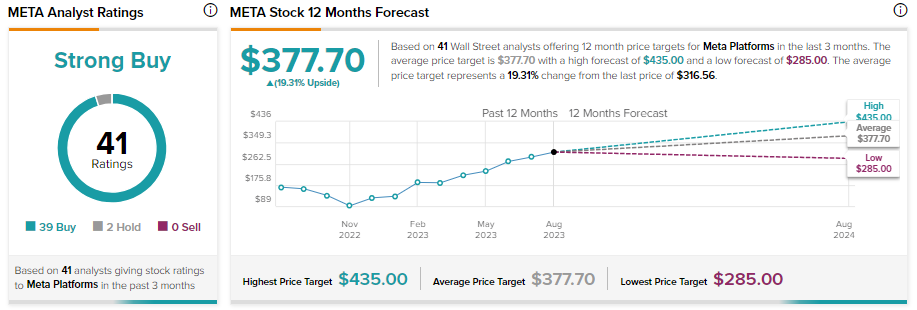

Thanks to its strong operating and financial performance, Meta Platforms stock has risen over 163% year-to-date. Despite this massive growth, 39 out of 41 analysts recommend a Buy on Meta stock. Impressively, analysts’ average price target of $377.70 implies a further upside potential of 19.31% from current levels.