Shares of BitNile Holdings, Inc. (NYSE: NILE) surged over 50% on March 21, after the company announced an upstream merger between its subsidiaries. Imperalis Holding Corp., a publicly-traded subsidiary of BitNile, will acquire NILE’s other subsidiary, TurnOnGreen.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Notably, the acquisition of TurnOnGreen by Imperalis will result in a pureplay publicly-traded company, TurnOnGreen. The newly formed company will focus on the development, manufacturing, and sales of its proprietary power solutions and electric vehicle charging systems, serving both residential and commercial segments.

BitNile Holdings, Inc., formerly known as Ault Global Holdings, Inc., is a provider of Bitcoin mining and data center operations. It is a diversified holding company, which pursues growth by acquiring undervalued businesses and disruptive technologies.

Details of the Deal

Through the deal, BitNile stockholders will receive approximately 140 million common shares of BitNile.

Further, shareholders will receive an equal number of warrants to purchase shares of TurnOnGreen at the time of the record date. The record date will be set based on regulatory approval and compliance with US federal securities laws.

Through the deal and potential listing, TurnOnGreen will be able to leverage public markets to drive further development and distribution of its innovative technology.

Upon completion of the deal, the current TurnOnGreen shall cease to exist and Imperalis will change its name to TurnOnGreen. TurnOnGreen will have two operating subsidiaries, TOG Technologies Inc. and Digital Power Corporation.

BitNile will support TurnOnGreen in pursuing an uplisting to the Nasdaq Capital Market, aligning with Nasdaq’s rules and other criteria for listing.

Upon the closing of the deal, which is subject to certain mandatory approvals, TurnOnGreen CEO, Amos Kohn will continue to lead the company.

Management Weighs In

TurnOnGreen CEO, Amos Kohn, commented, “TurnOnGreen has a team of experienced professionals, and we are excited about the stockholders of BitNile becoming stockholders of TurnOnGreen and together continuing the journey to deliver on the vision of making green energy technology a part of our everyday lives.”

BitNile Executive Chairman, Milton “Todd” Ault, III, stated, “We structured this transaction to benefit our stockholders who have been supportive of our transformation from a power solutions company in 2016 to a diversified holding company serving multiple sectors and developing and deploying an array of innovative technologies and products.”

Wall Street’s Take

The stock has picked up a rating from one analyst in the past three months.

Last week, Spartan Capital analyst Barry Sine initiated coverage of BitNile with a Buy rating and the price target of $7 (788.55% upside potential).

Sine forecasts that the company will transform into two publicly traded companies later this year.

The company considers BitNile shares to be a major “leveraged investment in bitcoin” based on the company’s expenditure worth $200 million on data centers, upgrades, and miners. He thinks that the company aims to become “a major bitcoin miner.”

Investors Weigh In

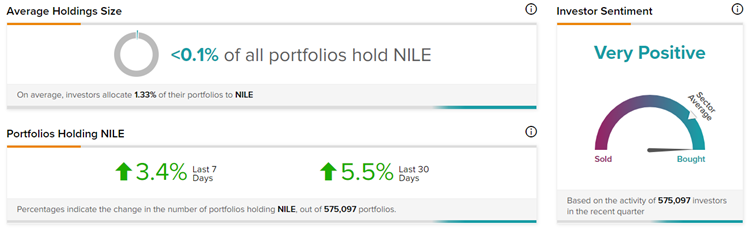

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on BitNile, with 5.5% of investors increasing their exposure to NILE stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

On Holding Delivers Robust Q4 Sales & Outlook; Shares Gain 14%

Pinduoduo Smashes EPS Estimates; Shares Gain 6% Pre-Market

Williams-Sonoma Shares Gain 8.2% on EPS Beat & 10% Dividend Hike