Merck (MRK) has announced that the U.S. Food and Drug Administration (FDA) has approved an expanded label for Keytruda, Merck’s anti-PD-1 therapy, as monotherapy for the treatment of adult patients with relapsed or refractory classical Hodgkin lymphoma (cHL).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Hodgkin lymphoma is a type of lymphoma that develops in the white blood cells called lymphocytes, which are part of the immune system. Worldwide, there were approximately 80,000 new cases of Hodgkin lymphoma, and more than 26,000 people died from the disease in 2018.

The approval is based on results from the Phase 3 KEYNOTE-204 trial in which Keytruda significantly reduced the risk of disease progression or death by 35% compared to brentuximab vedotin (BV).

Additionally, median progression-free survival (PFS) was 13.2 months for patients treated with Keytruda and 8.3 months for patients treated with BV. The FDA also approved an updated pediatric indication for the therapy for the treatment of pediatric patients with refractory cHL, or cHL that has relapsed after two or more lines of therapy.

“An estimated 8,500 patients in the U.S., many of them 40 years of age or younger, will be diagnosed with cHL this year. Now patients with cHL who progress after frontline therapy have a new option in Keytruda, which has demonstrated a clinically meaningful improvement in progression-free survival,” commented Merck’s Dr. Vicki Goodman. “Today’s FDA approval builds upon our growing range of options for people with blood cancers.”

Keytruda is an anti-PD-1 therapy that works by increasing the ability of the body’s immune system to help detect and fight tumor cells. It is a humanized monoclonal antibody that blocks the interaction between PD-1 and its ligands, PD-L1 and PD-L2, thereby activating T lymphocytes which may affect both tumor cells and healthy cells.

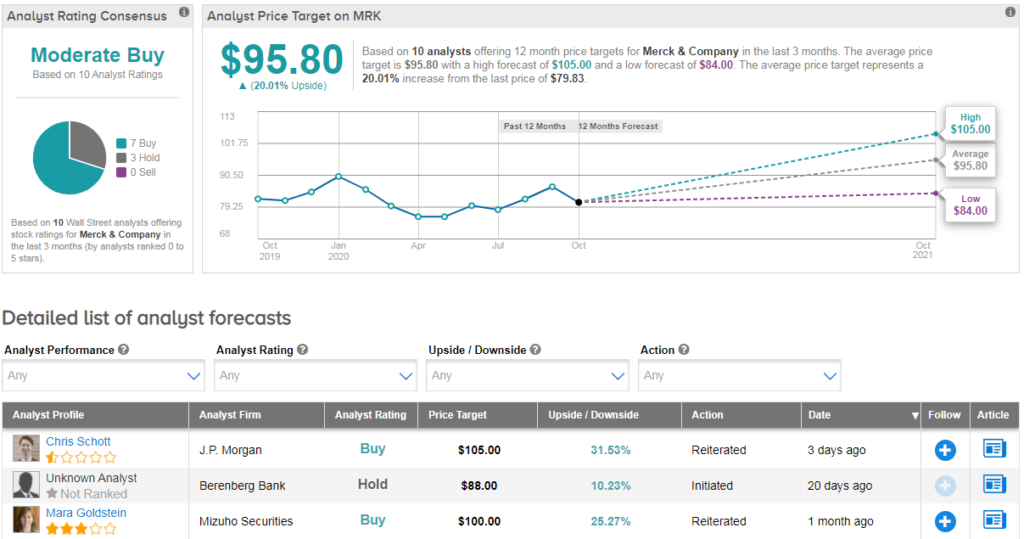

Merck shares are currently trading down 12% year-to-date, and analysts have a cautiously optimistic Moderate Buy consensus on the stock. That breaks down into 7 Buy ratings versus 3 Hold ratings. Meanwhile, the average analyst price target of $96 implies 20% upside potential in the coming year.

Mizuho Securities analyst Mara Goldstein recently reiterated a Buy rating on the stock with a $100 price target (reflecting 25% upside potential), saying that oncology is seeing a rebound from Covid-19.

“The growth in Keytruda continues to drive transformation in the P&L and is supportive of our investment thesis,” Goldstein wrote in a note to investors. The analyst expects Keytruda to drive operating margin expansion and offset negative pressure from loss of exclusivity for other products. (See Merck stock analysis on TipRanks)

Related News:

Zogenix Rallies 7% On New Fintepla Data For Dravet Syndrome

Zynerba Up 6% As Zygel Shows Promise In Autism Trial

Amarin Pops 4% After-Hours On Positive PCI Data For Vascepa