Global automotive provider of light detection and ranging (Lidar) hardware and software technology, Luminar Technologies (NASDAQ: LAZR) announced that its Iris Lidar technology will be integrated into luxury carmaker Mercedes-Benz’s production vehicle platform.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

This, in turn, will enhance the development of fully automated driving on highways for next-generation Mercedes passenger cars.

Following the news, shares of Luminar gained 11.5% to close at $15 on Thursday.

Partnership Terms

Along with the partnership, the German automaker will acquire 1.5 million LAZR shares as an equity stake worth around $20.2 million.

Commercially, the partnership is a clear win for Luminar. Its Iris lidar technology is being leveraged as it continues to execute towards series production.

Vehicle safety and the technical potencies of highly automated driving systems are anticipated to improve through this technology, which helps avoid road obstructions by measuring distance and detecting obstacles on time.

Last year, the self-driving sensor maker inked deals with other automakers, including Volvo and China’s SAIC.

Official Comments

Luminar CEO, Austin Russell said, “This partnership is a landmark moment in the industry, demonstrating how substantially increased safety and autonomous driving functions on consumer vehicles are going from sci-fi to mainstream.”

Wall Street’s Take

On December 14, R.F. Lafferty analyst Jaime Perez maintained a Buy rating on the stock with a price target of $37 (146.67% upside potential). However, Perez expects Luminar Technologies to report a loss per share of $0.15 for the fourth quarter of 2021.

Consensus among analysts is a Strong Buy based on 6 Buys versus 1 Hold. The average Luminar Technologies price target of $30 implies 100% upside potential from current levels. Meanwhile, shares have dropped 16.4% over the past six months.

Risk Analysis

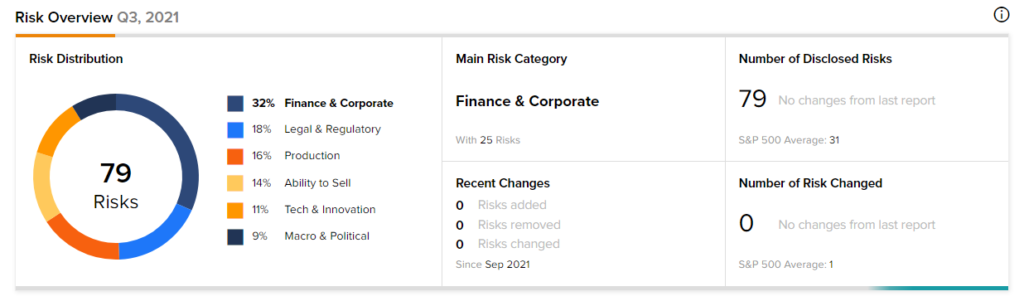

According to the new TipRanks Risk Factors tool, the Luminar Technologies stock is at risk mainly from three factors: Finance and Corporate, Legal and Regulatory and Production, which contribute 32%, 18%, and 16%, respectively, to the total 79 risks identified for the stock.

Luminar Technologies shares have gained, following the recent partnership. But given the already high-risk profile of the company and disappointing price performance over the past six months, investors might be wary before adding this stock to their portfolio.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Morgan Stanley Reports Upbeat Q4 Earnings; Shares Gain

Valneva Releases Promising Data on Vaccine Against Omicron

Gamida Cell to Submit Biologics License Application for Omidubicel; Shares Jump