MercadoLibre (NASDAQ:MELI) stock gained about 5% yesterday and a further 1.5% in after-hours trading. The upside can be attributed to the company’s stellar performance in the third quarter, as both revenue and earnings exceeded expectations. The e-commerce giant’s Q3 income from operations hit a record high of $685 million, up 131% year-over-year, benefitting from robust growth in revenues from Mexico and Brazil.

Q3 Snapshot

Earnings per share came in at $7.18, which beat analysts’ consensus estimate of $5.88 per share. Also, the bottom line rose substantially from $2.57 in the year-ago quarter. Meanwhile, Q3 sales increased by 41.3% year-over-year to $3.76 billion and surpassed the analysts’ expectations by $189 million.

In terms of key metrics, the company’s total payment volume went up by 121.2% year-over-year on a currency-neutral basis to $47.3 billion, while gross merchandise volume increased 59.3% year-over-year to $11.4 billion on a currency-neutral basis.

MercadoLibre’s impressive performance is driven by a 27% year-over-year increase in items sold in Brazil. This marks the highest rate of growth since the fourth quarter of 2021. At the same time, items sold accelerated to 38% in Mexico, the highest since 2021. The growth can be attributed to the relaunch of MELI’s loyalty program and other benefits.

Is MELI a Good Buy Now?

MercadoLibre’s increasing profitability on the back of strategic growth efforts, including marketing campaigns and new fulfillment centers in key areas, is impressive. Furthermore, the company’s revamped loyalty program should continue to drive growth in Brazil and Mexico.

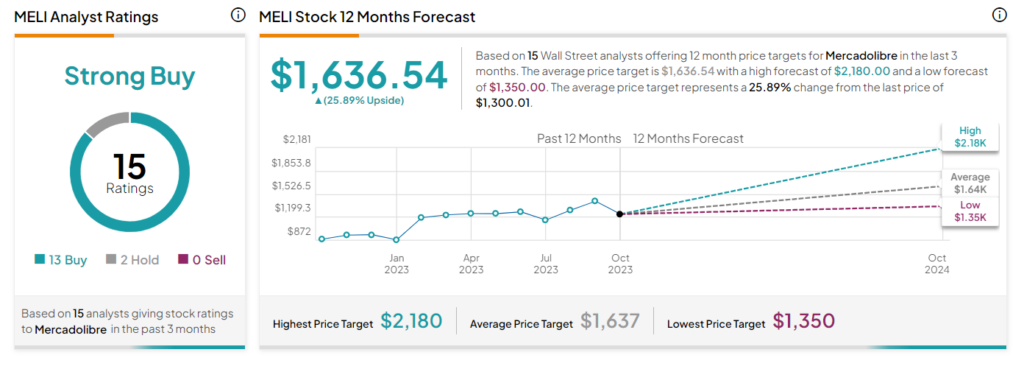

On TipRanks, MercadoLibre stock has a Strong Buy consensus rating based on 13 Buys and two Holds. The average stock price target of $1,636.54 implies a 25.9% upside potential. The stock is up nearly 58% so far in 2023.